Find the right fit - whether you need a strategic AI partner, a tailored solution, or ready-to-go technology.

"7IM is a business that has a long history of putting its clients first by staying at the forefront of technological innovation. This approach is reflected in the choice to partner with Aveni for strategic AI adoption."

“Aveni Detect is already helping us to support quality assurance across our customer interactions and helping to identify customer vulnerabilities and enhance our support mode.”

“We have seen really positive feedback from our team, response to the Aveni Assist tool has been excellent and we are very pleased with the results and business impact so far. We’ve been really well supported by Aveni as we have gone through this process.”

“This technology has the capability to substantially reduce the administrative burden on advisers, freeing them up to devote more time to meeting their clients’ needs.”

“At Octopus Money, we’re always looking for ways to ensure every customer gets the money support they need - not just the wealthiest few. Aveni’s solutions are helping us digitise and streamline our customer call reviews, ensuring we maintain the highest standards while reducing the time spent on manual processes.”

“Our partnership with Aveni shows our commitment to using technology to ensure the quality of our advice. Aveni Detect enables us to identify vulnerable and other high risk clients, helping us support them in the best possible way.”

“Aveni Detects allows our Risk, Compliance and Quality teams to have much more oversight of the entire business, using the same resource but focused on areas that add the most value to our clients and the business along with assurance to myself, the rest of the Board and the regulator.”

AI designed specifically for the financial services industry.

We combine NLP expertise with deep financial services experience.

Data security is at the heart of our business operations.

Human+ approach to empower your financial advisers and agents.

Trusted by leading organisations across

the FS industry.

Our NLP experts are consistently ranked in the top 100 globally.

From admin tasks to quality assurance, our AI simplifies processes and sharpens oversight. Automatically surface key risks, reduce manual effort, and ensure every interaction meets your compliance standards.

Cut admin time with automation

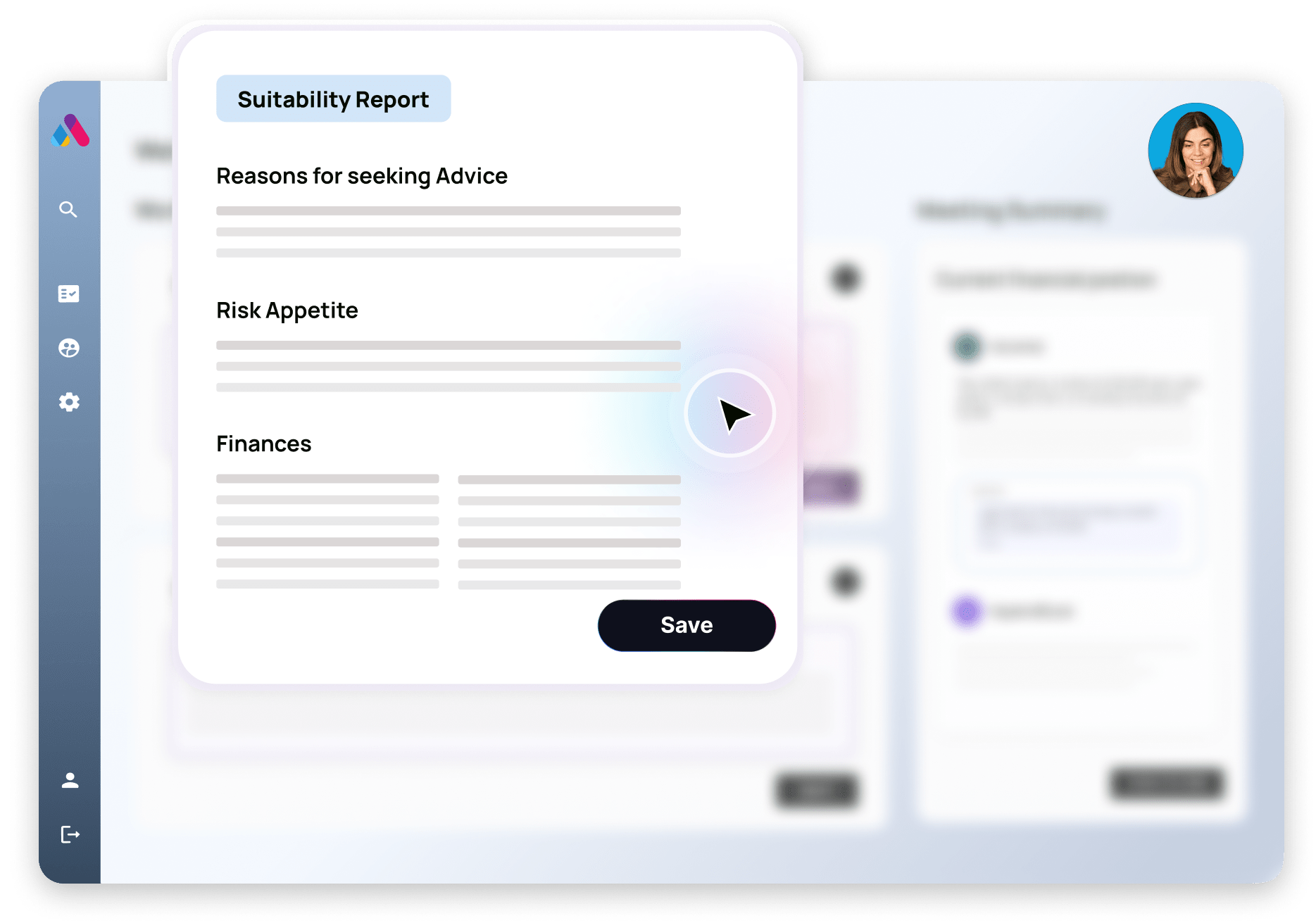

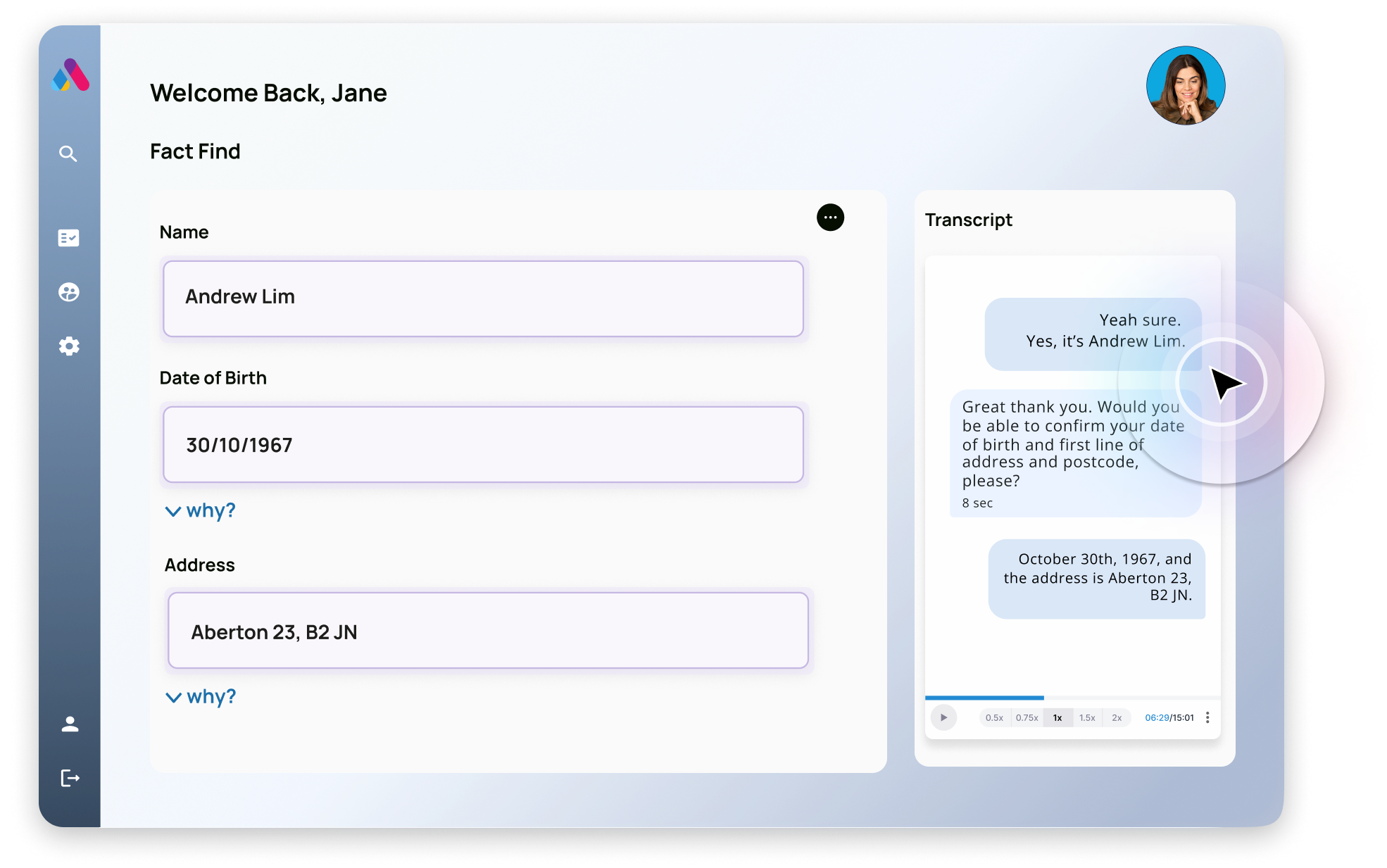

Cut admin time with automation Focus on what matters by allowing Aveni Assist to automatically administer your CRM, generate suitability reports and detailed client emails within minutes of completing a call.

Understand where Aveni Assist has taken information from, with transparent and direct referencing back to the original call transcript.

Integrated

Integrated Seamless integration with MS Teams, Google Meet and Zoom, means Aveni Assist is quick to set-up and get started with.

Auto QA

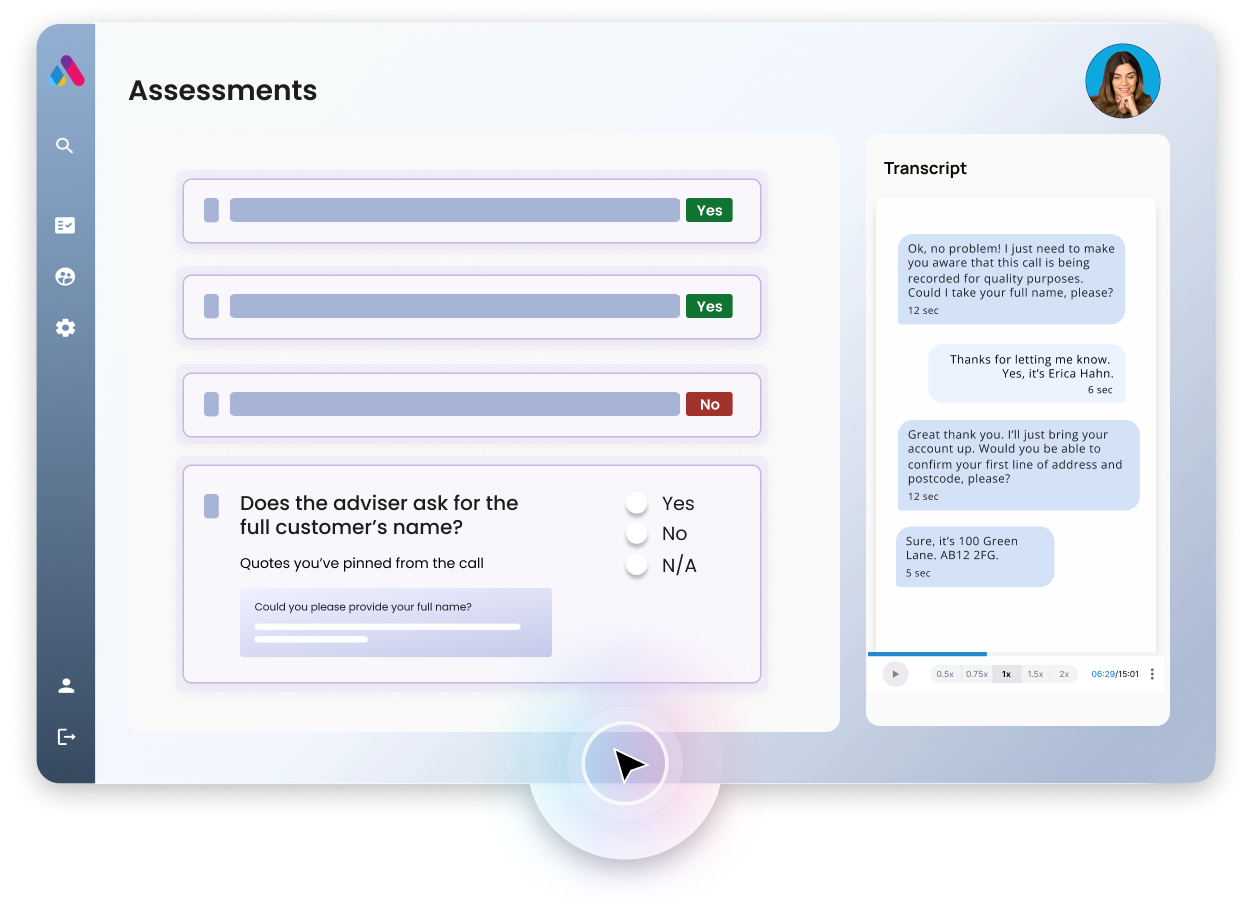

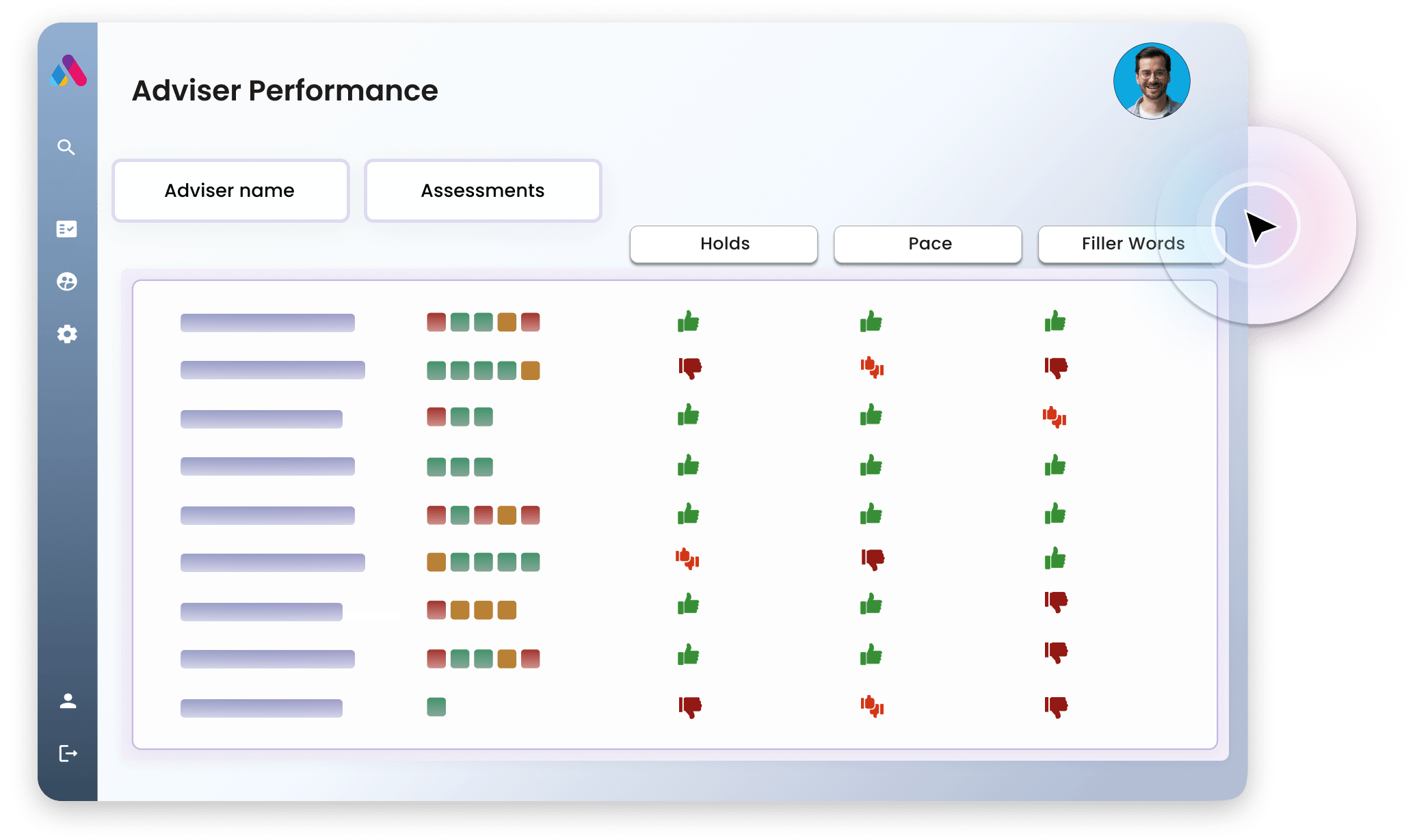

Auto QA AI driven automation at all stages of the QA workflow significantly reduces the time taken to complete an assessment and ensures assessor effort is spent on the highest value interactions.

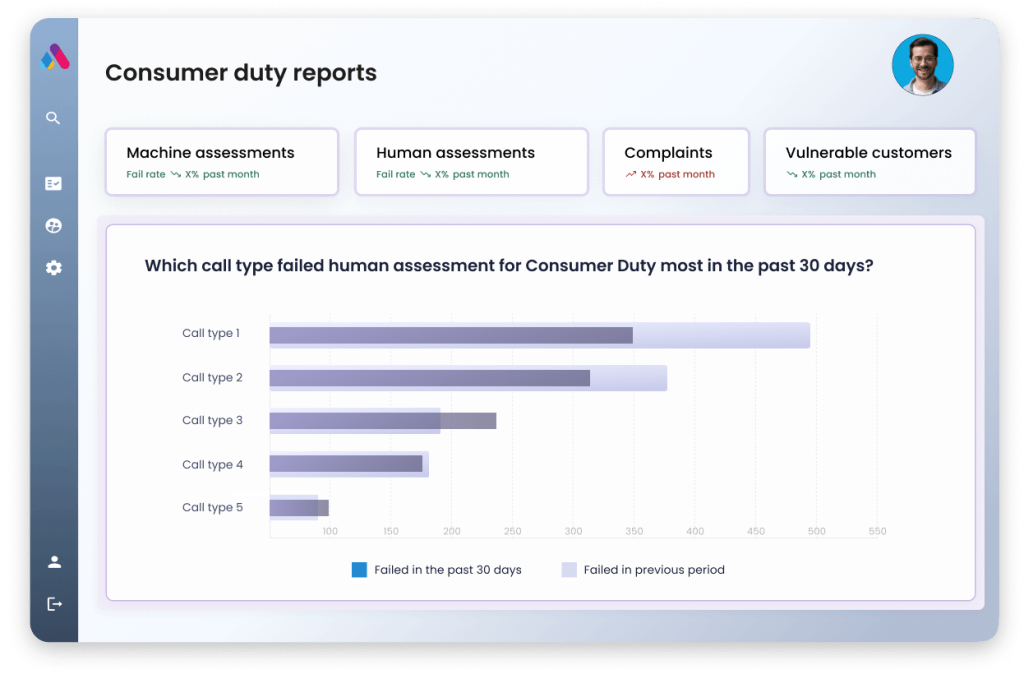

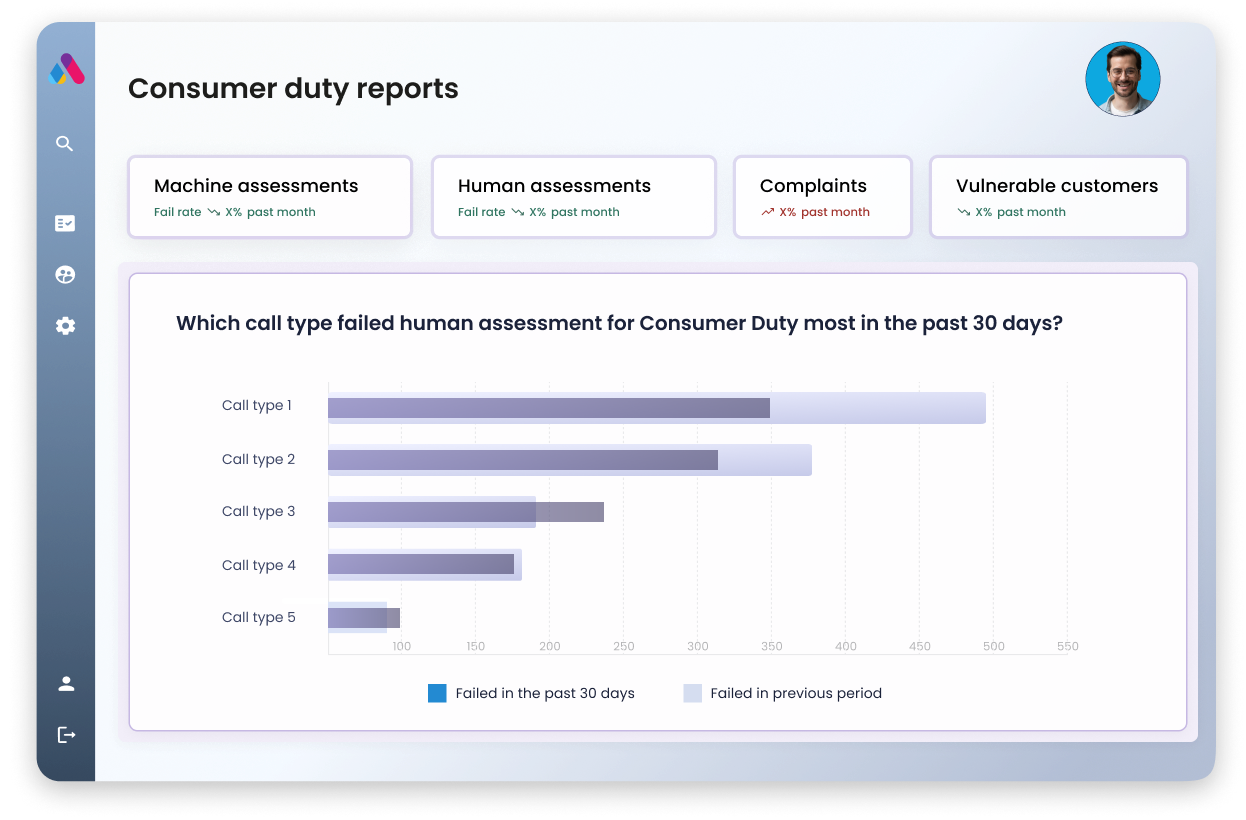

Automatically track and analyse Consumer Duty performance indicators with machine assessment of every call.

Coaching & Performance

Coaching & Performance Analyse every call to define conversational excellence. Assess key metrics like filler words, clarity and pace for more focused, personalised training.

Be the first to hear about new features, releases, and best-practice guides.

See how Aveni can work for your business