SME BUSINESSES

Small financial services business don’t have time for lengthy AI implementations. That’s why Aveni delivers out-of-the-box AI solutions that instantly enhance efficiency, compliance, and risk management. No complex setup. No IT burden. Just powerful automation that works from day one.

Cut admin time with automation

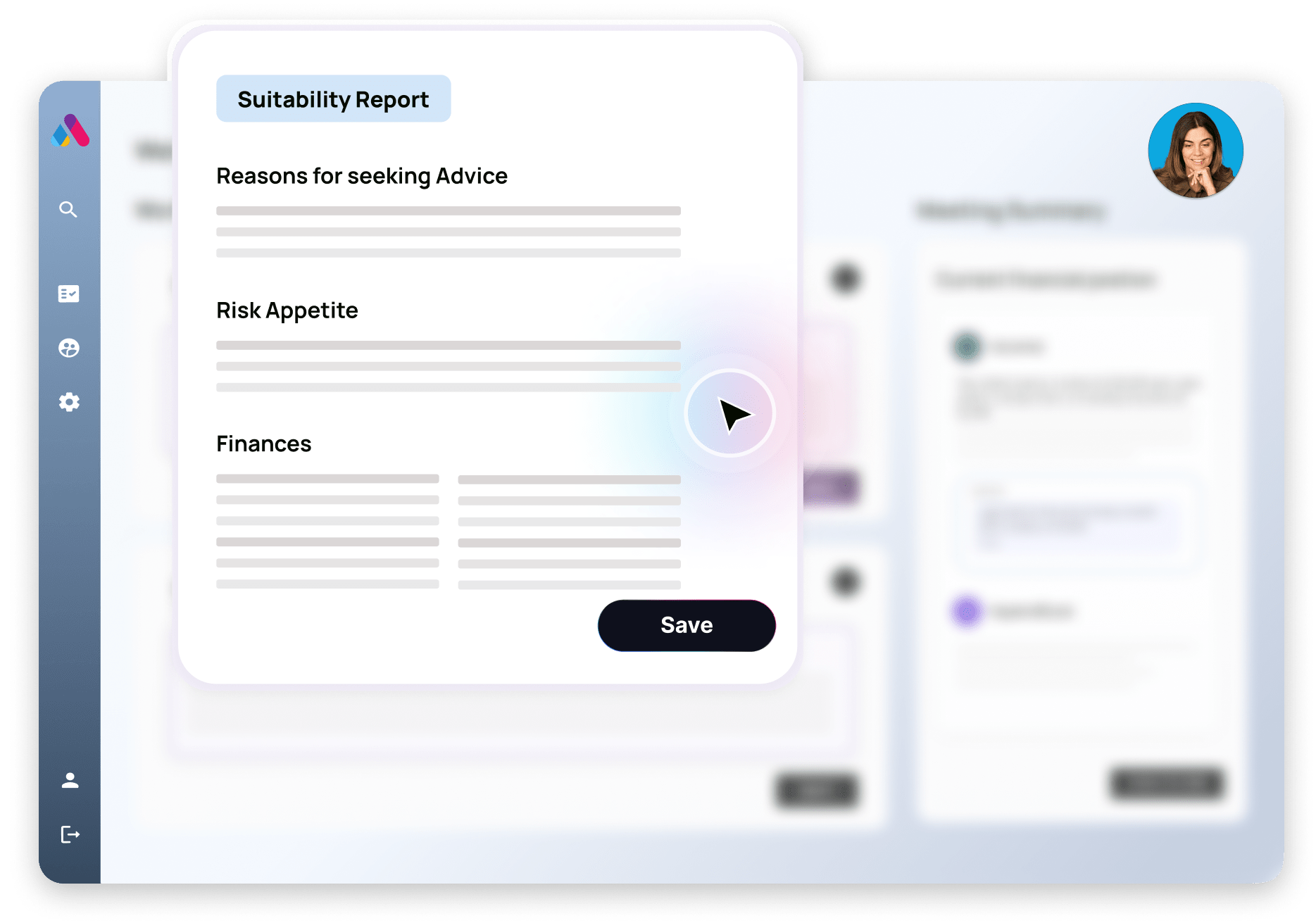

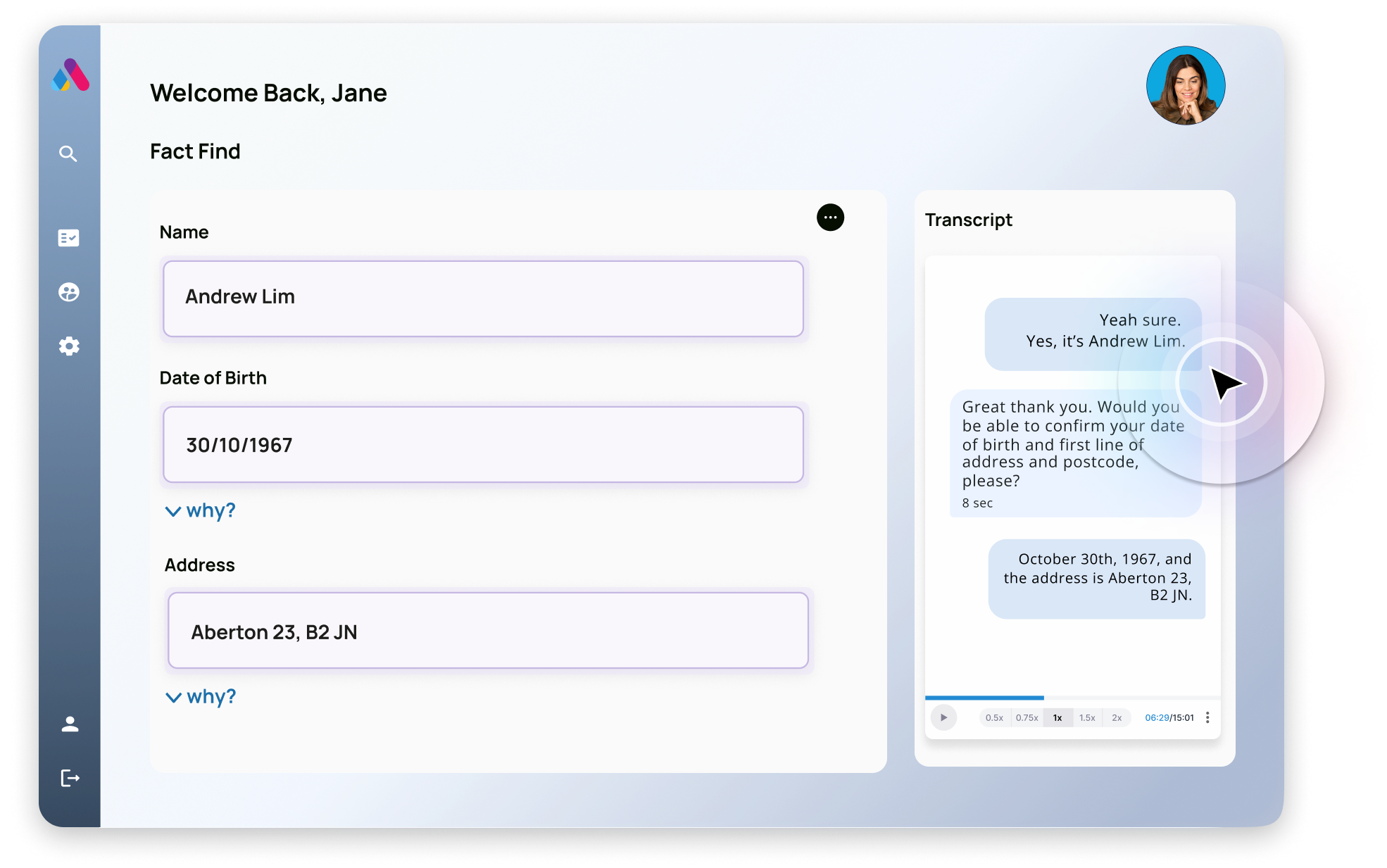

Cut admin time with automation Focus on what matters by allowing Aveni Assist to automatically administer your CRM, generate suitability reports and detailed client emails within minutes of completing a call.

Understand where Aveni Assist has taken information from, with transparent and direct referencing back to the original call transcript.

Integrated

Integrated Seamless integration with MS Teams, Google Meet and Zoom, means Aveni Assist is quick to set-up and get started with.

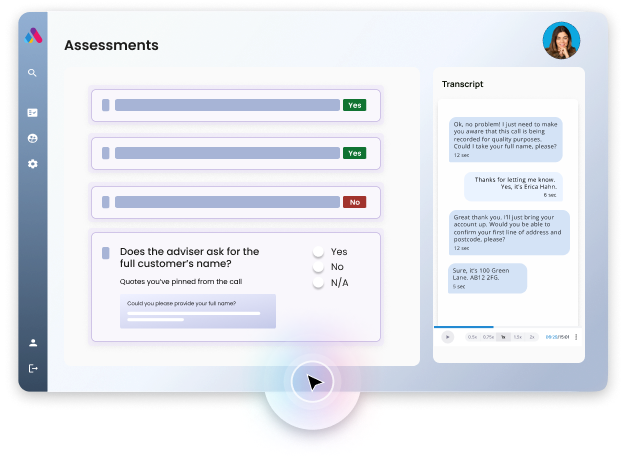

Auto QA

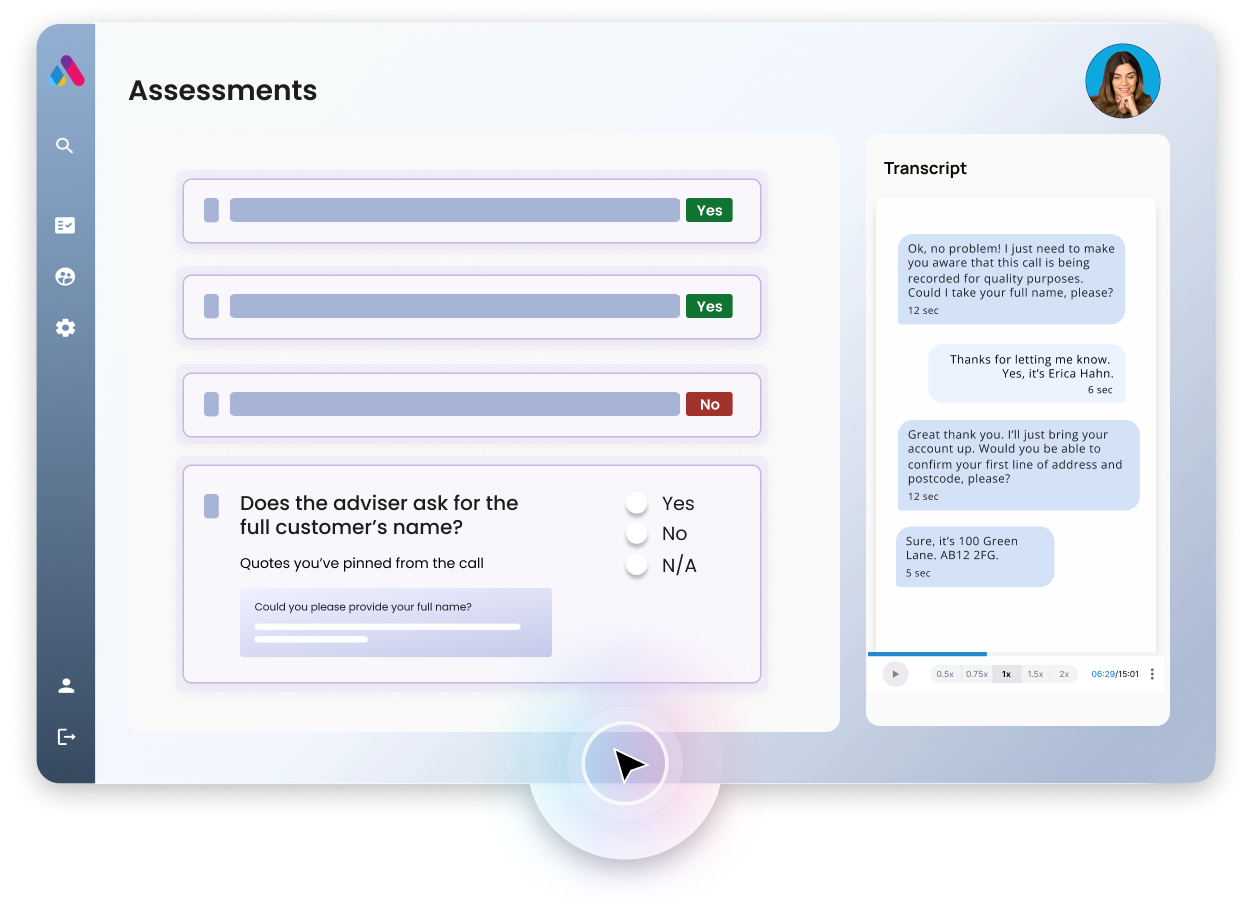

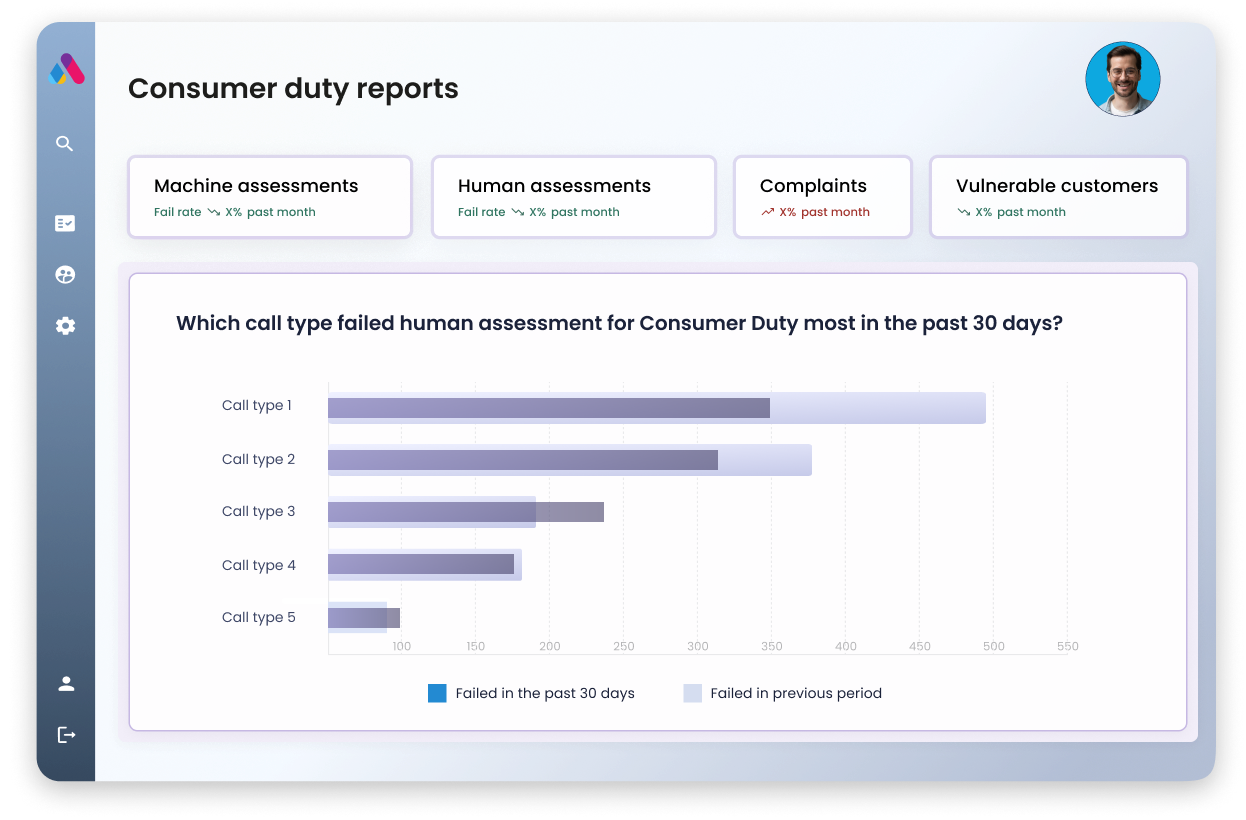

Auto QA AI driven automation at all stages of the QA workflow significantly reduces the time taken to complete an assessment and ensures assessor effort is spent on the highest value interactions.

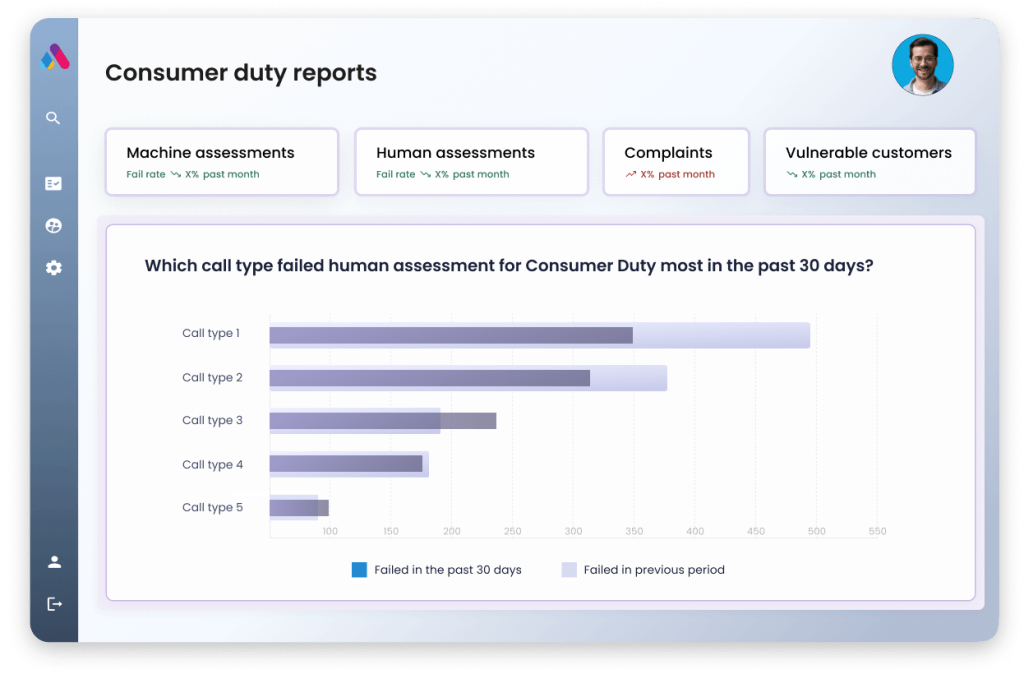

Automatically track and analyse Consumer Duty performance indicators with machine assessment of every call.

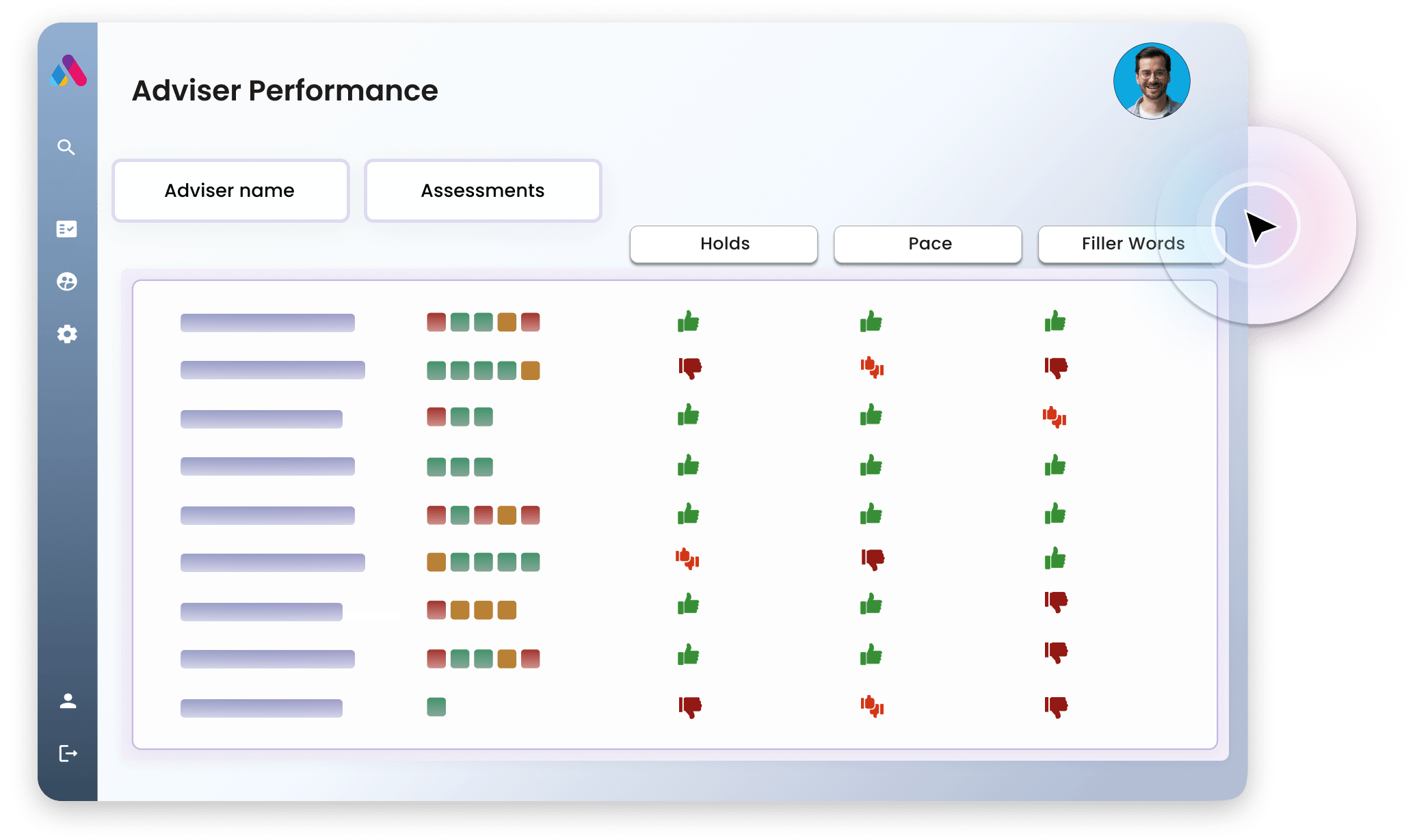

Coaching & Performance

Coaching & Performance Analyse every call to define conversational excellence. Assess key metrics like filler words, clarity and pace for more focused, personalised training.

Instant Impact - deploy AI without months of configuration. Get started in days, not weeks.

Effortless Efficiency - automate meeting admin, report generation and CRM admin with AI.

Regulatory Confidence - 100% coverage at a fraction of the cost. Strengthen Consumer Duty compliance and reduce regulatory risk.

No IT Overhaul - our AI slots into your existing processes - no complex integrations needed.

"7IM is a business that has a long history of putting its clients first by staying at the forefront of technological innovation. This approach is reflected in the choice to partner with Aveni for strategic AI adoption."

“Aveni Detect is already helping us to support quality assurance across our customer interactions and helping to identify customer vulnerabilities and enhance our support mode.”

“We have seen really positive feedback from our team, response to the Aveni Assist tool has been excellent and we are very pleased with the results and business impact so far. We’ve been really well supported by Aveni as we have gone through this process.”

“This technology has the capability to substantially reduce the administrative burden on advisers, freeing them up to devote more time to meeting their clients’ needs.”

“At Octopus Money, we’re always looking for ways to ensure every customer gets the money support they need - not just the wealthiest few. Aveni’s solutions are helping us digitise and streamline our customer call reviews, ensuring we maintain the highest standards while reducing the time spent on manual processes.”

“Our partnership with Aveni shows our commitment to using technology to ensure the quality of our advice. Aveni Detect enables us to identify vulnerable and other high risk clients, helping us support them in the best possible way.”

“Aveni Detects allows our Risk, Compliance and Quality teams to have much more oversight of the entire business, using the same resource but focused on areas that add the most value to our clients and the business along with assurance to myself, the rest of the Board and the regulator.”

At Aveni, we place the highest priority on data security and privacy throughout all stages of model training and development. We are ISO 27001 certified, adhering to internationally recognised standards for managing information securely. We also ensure full compliance with the UK GDPR. All data is securely stored on AWS S3 with server-side encryption (AES-256), and encryption keys are regularly rotated to maintain security.

We take a ‘privacy by design’ approach. Our AI assistant only records and transcribes meetings when it is explicitly invited to do so and with clear user consent. Users have full control over when and how their data is used. Importantly, when it comes to third-party AI providers, we maintain strict policies and procedures to guarantee that customer data is not utilised in any way to train their AI systems. By embedding privacy into our technology and operational practices from the outset, we maintain trust and safeguard sensitive information at every step.

Aveni integrates with leading CRM systems such as intelliflo office, Xplan and Genesys. We’d be happy to discuss your existing tech stack to ensure we can meet your integration requirements.

Aveni helps financial services firms meet regulatory requirements by using AI to monitor and analyse 100% of customer calls and documents. This ensures unparalleled oversight of key risks such as conduct, complaints, suitability, and customer vulnerability, supporting compliance with frameworks like the FCA’s Consumer Duty. By automating monitoring, record-keeping, and reporting, Aveni reduces operational burden while enhancing transparency, auditability, and the fair treatment of customers.

Aveni stands out from other solutions by offering a platform purpose-built for financial services, combining deep regulatory expertise with advanced AI. Unlike basic transcription tools, Aveni not only monitors 100% of customer interactions for conduct, suitability, and vulnerability risks to meet FCA and Consumer Duty requirements (Aveni Detect), but also transforms post-meeting processes (Aveni Assist). Our platform helps advisers by automating admin tasks, generating high-quality suitability reports, and updating CRM systems within minutes of a meeting. Backed by our world-class NLP team, proprietary FinLLM, and seven years of industry experience, Aveni delivers domain-specific insights and automation that far surpass newer generative AI tools.

Aveni delivers significant cost savings across both compliance and operational functions through its dual Assist and Detect capabilities. On the Assist side, our AI automates time-consuming post-meeting tasks such as writing suitability reports, updating CRM systems, and summarising client conversations—cutting adviser admin time by up to 70% and allowing them to focus more on client service and relationship building. On the Detect side, Aveni replaces costly manual QA and compliance monitoring processes by analysing 100% of customer interactions in real time, reducing the need for large oversight teams while improving accuracy and risk coverage.

We offer detailed value calculators for both Assist and Detect, allowing firms to estimate potential savings based on team size, volume of interactions, and time currently spent on admin or QA.