Advice networks face a unique challenge: maintaining compliance and consistency across hundreds of distributed advisers, while supporting members to deliver high-quality client experiences. Manual file checking and compliance audits are costly, inconsistent, and hard to scale.

We automate adviser documentation, flag compliance risks across every interaction, and provide networks with centralised oversight that scales across your member firms. The result: stronger compliance, more efficient advisers, and measurable ROI within weeks.

Networks carry regulatory responsibility but rely on manual QA and file reviews. Scaling oversight across hundreds of firms is expensive and inconsistent.

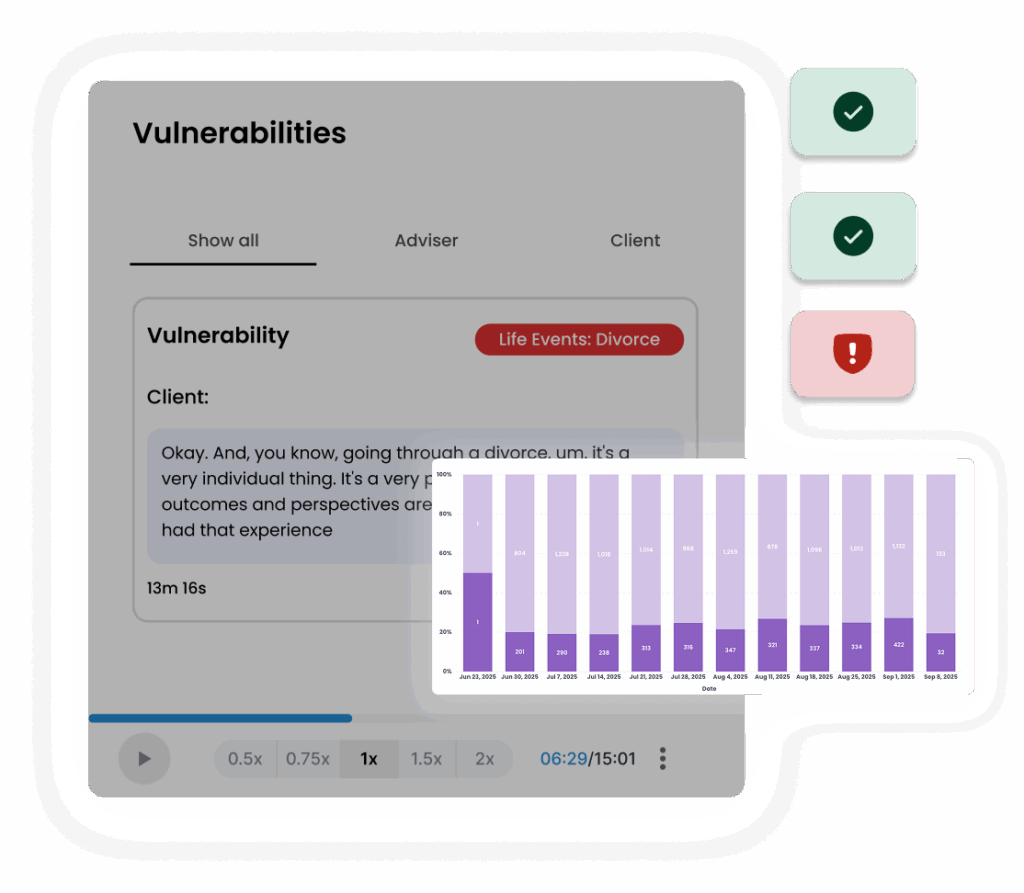

With Consumer Duty and vulnerable client oversight under the spotlight, networks must prove they can monitor, manage, and report on outcomes across every adviser.

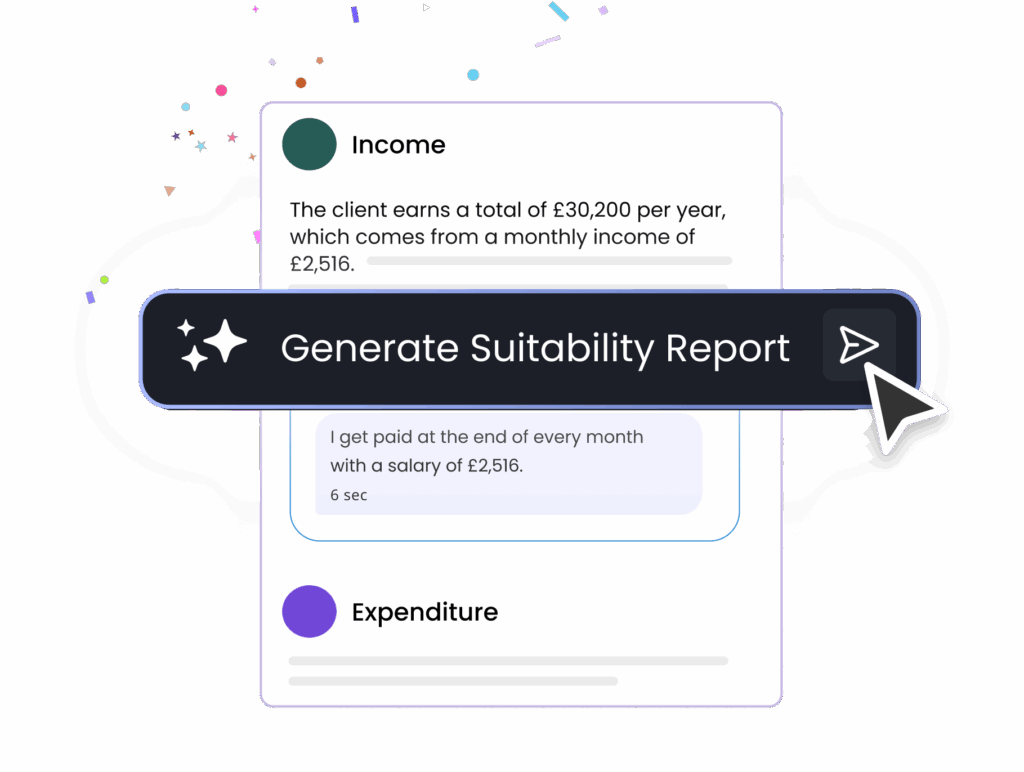

Advisers spend hours each week on admin and suitability documentation, reducing client service capacity and straining margins.

Networks need tools that deliver consistent standards, without mandating systems that their members resist or can’t integrate.

Automate file checks and adviser admin with ROI in weeks, not months.

Designed to support compliance oversight without disrupting member firms.

Proven with large-scale wealth and advice organisations across the UK.

Built for regulated financial services, aligning with FCA requirements.

From pilot to full network rollout, we help you grow adoption across distributed adviser bases.

Networks own the regulatory risk but don’t always have the tools to manage it at scale. Aveni changes that. By automating file checks, streamlining adviser admin, and monitoring every client interaction, we help you safeguard compliance while enabling members to grow.

Show ROI before year-end, evidence Consumer Duty outcomes, and set your network apart as a leader in compliance and adviser productivity with AI for advice networks.