UK wealth firms face a dual challenge: scale adviser capacity and stay compliant under rising regulatory pressure.

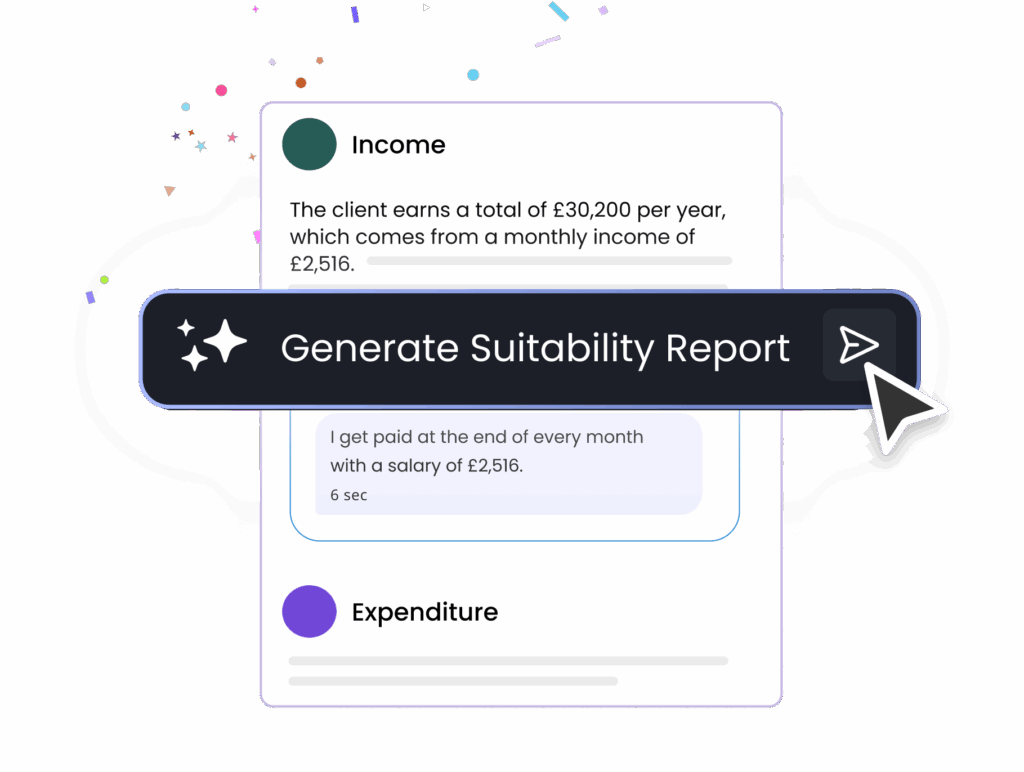

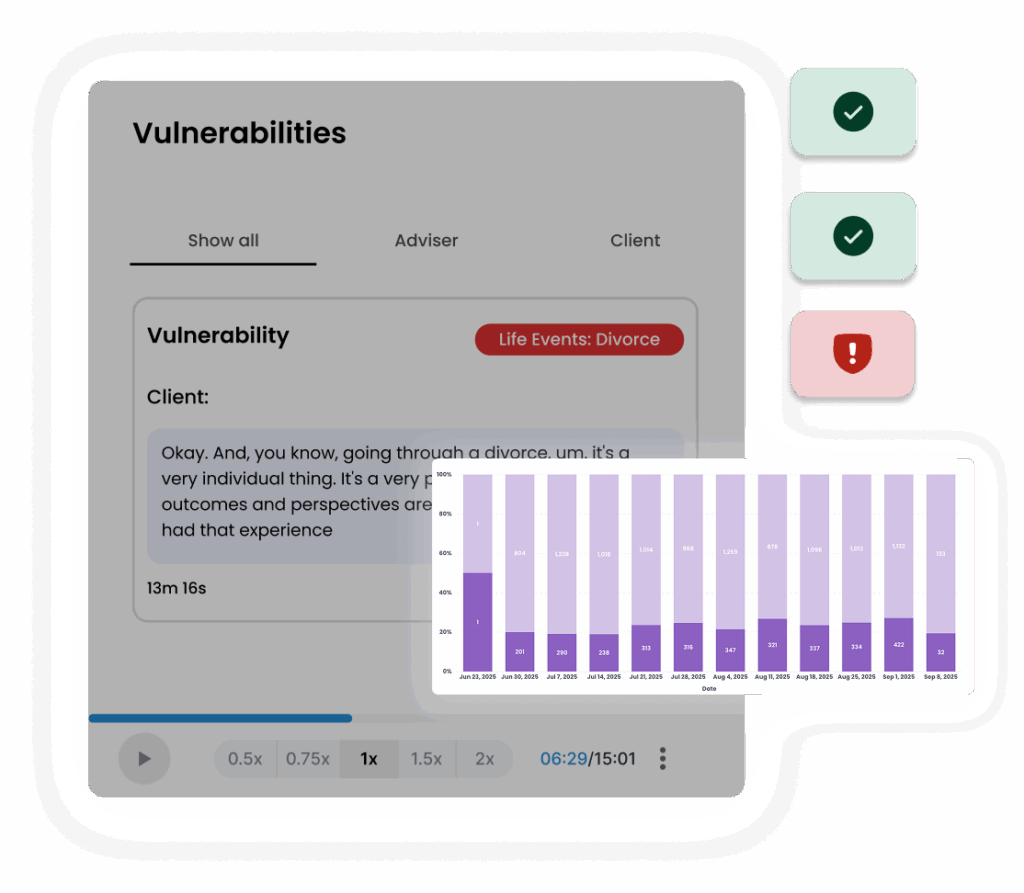

It streamlines adviser workflows, cutting hours of manual admin, while monitoring every client interaction to ensure compliance and protect your business.

We partner with national wealth firms to deploy AI that works immediately, integrates seamlessly, and drives measurable ROI within weeks.

Advisers spend too much time on post-meeting admin and suitability documentation, slowing client service and limiting growth.

Consolidators and national wealth firms must integrate disparate systems and processes while driving scale without growing headcount.

Increasing FCA focus on Consumer Duty and vulnerable clients puts meetings under the microscope. Firms need centralised, real-time oversight.

Delays in reports and inconsistencies across advisers erode client trust, especially in affluent and HNW segments.

Tangible ROI in weeks, not months.

Proven with national firms.

Already delivering results with 2 of the UK’s 4 largest banks and multiple top-tier wealth managers.

AI built specifically for regulated financial services.

From first deployment to enterprise-wide adoption, we grow with you.

Act today and show measurable ROI before year-end. Aveni’s AI platform transforms adviser admin into minutes, scales QA to 100%, and strengthens Consumer Duty oversight from day one.

Prove value this quarter, unlock budget, and build the foundation for scalable, compliant growth.