For Discretionary Fund Managers (DFMs) and private banks, adviser time is at a premium and client expectations are exacting. Firms must balance bespoke, high-touch service with the growing demands of regulation. Productivity pressures, compliance oversight, and the need to evidence Consumer Duty outcomes are intensifying.

It automates post-meeting documentation, captures investment rationale consistently, and provides compliance oversight on sensitive client conversations, without disrupting the adviser–client relationship.

High-cost advisers spend too much time on admin, reducing their ability to serve clients and grow assets under management.

Clients expect tailored, white-glove service. Efficiency gains can’t come at the expense of trust or personalisation.

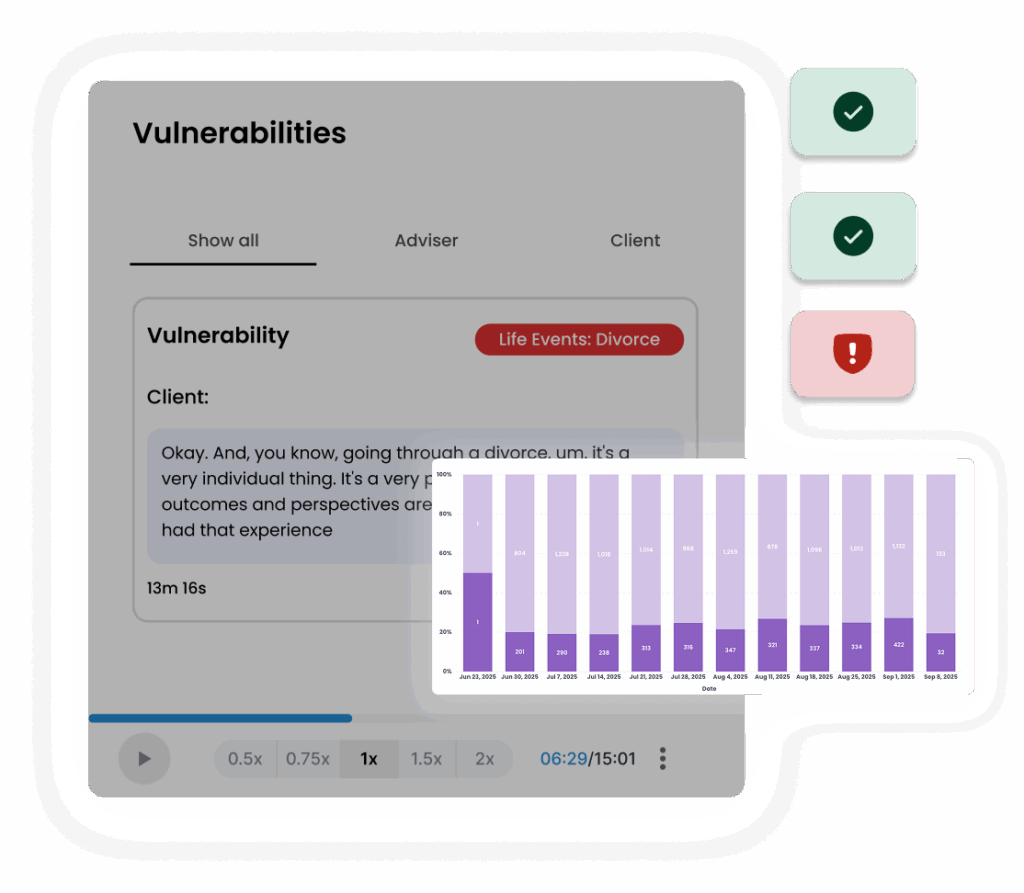

High-value, sensitive client interactions are under increasing scrutiny. Firms must evidence compliance across every discussion.

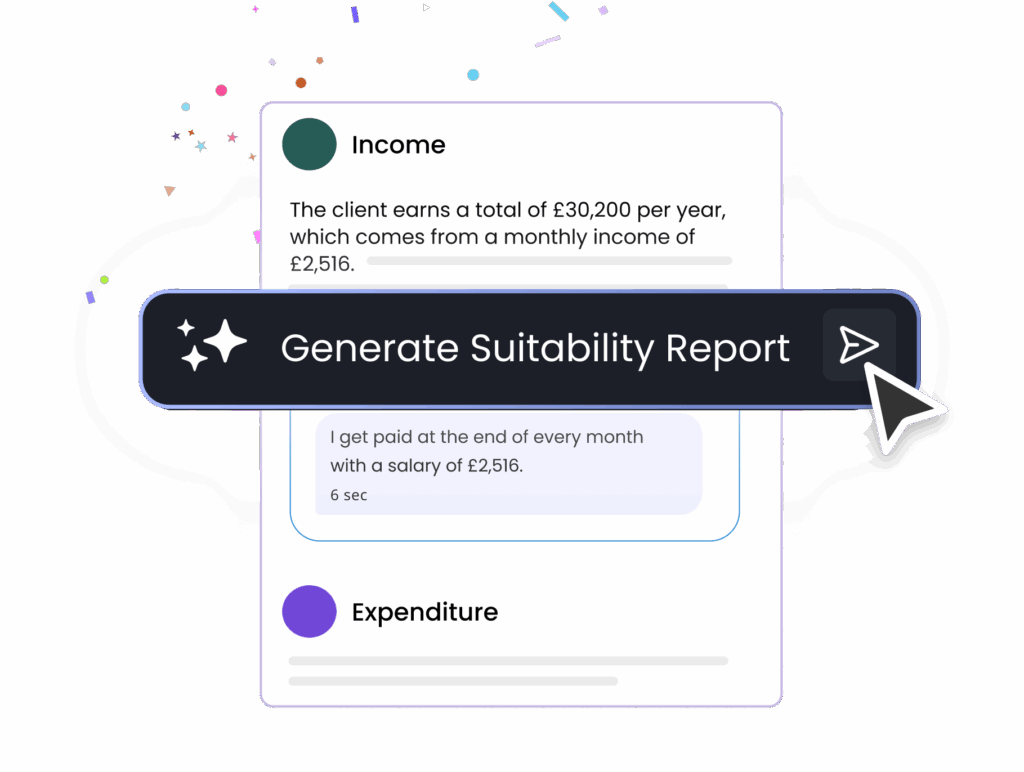

Automates time-intensive admin, freeing advisers for client-facing work.

Compliance oversight designed for sensitive, complex conversations.

Proven with leading DFMs and wealth managers across the UK.

Built for regulated financial services, aligned to FCA expectations.

Works alongside existing systems, preserving adviser focus on client relationships

Advisers in DFMs and private banks need to focus on clients, not admin. Our AI for private banks streamlines documentation, safeguards sensitive client conversations, and ensures Consumer Duty compliance, all without compromising the bespoke experience your clients expect.

Free up adviser time, strengthen compliance, and deliver ROI within weeks.