Focus assessor time on the highest risk cases. Automate document check and assessment processes to boost productivity of your QA teams.

Random QA misses risks. Aveni Auto QA reviews 100% of calls, flagging pressure tactics, policy mis-selling or missed affordability checks - before they trigger complaints.

Manual QA can't keep up with tailored, high-risk advice. Aveni analyses every client conversation, flagging unclear risk warnings or poor suitability so you stay ahead of the regulator.

Widespread adviser networks mean compliance gaps. Auto QA provides full coverage, spotting conduct risks, missed disclosures and inconsistent messaging across every interaction.

"7IM is a business that has a long history of putting its clients first by staying at the forefront of technological innovation. This approach is reflected in the choice to partner with Aveni for strategic AI adoption."

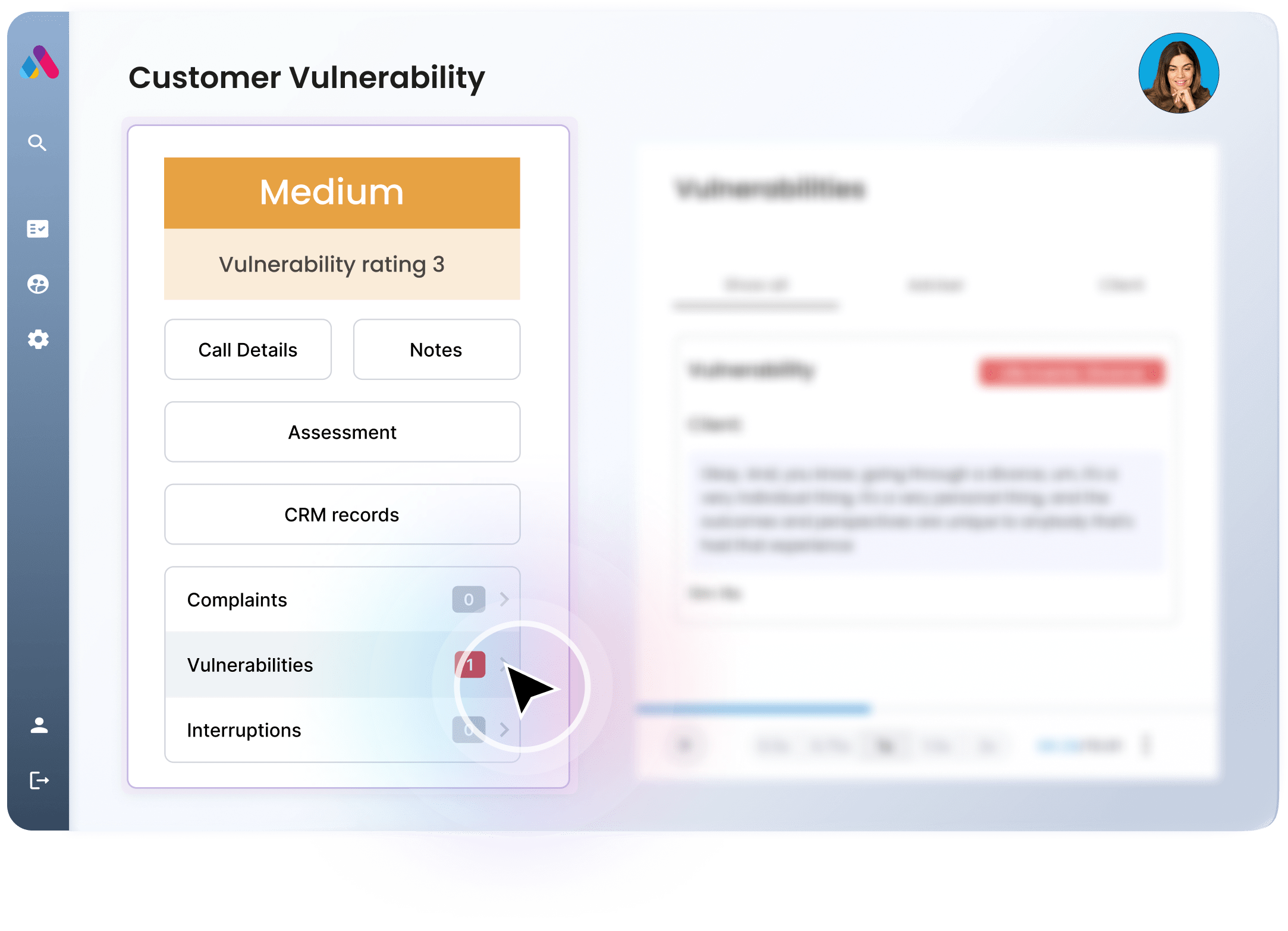

“Aveni Detect is already helping us to support quality assurance across our customer interactions and helping to identify customer vulnerabilities and enhance our support mode.”

“We have seen really positive feedback from our team, response to the Aveni Assist tool has been excellent and we are very pleased with the results and business impact so far. We’ve been really well supported by Aveni as we have gone through this process.”

“This technology has the capability to substantially reduce the administrative burden on advisers, freeing them up to devote more time to meeting their clients’ needs.”

“At Octopus Money, we’re always looking for ways to ensure every customer gets the money support they need - not just the wealthiest few. Aveni’s solutions are helping us digitise and streamline our customer call reviews, ensuring we maintain the highest standards while reducing the time spent on manual processes.”

“Our partnership with Aveni shows our commitment to using technology to ensure the quality of our advice. Aveni Detect enables us to identify vulnerable and other high risk clients, helping us support them in the best possible way.”

“Aveni Detects allows our Risk, Compliance and Quality teams to have much more oversight of the entire business, using the same resource but focused on areas that add the most value to our clients and the business along with assurance to myself, the rest of the Board and the regulator.”