Wealth consolidators are under pressure to deliver efficiency gains across diverse, acquired firms. But disparate systems and workflows make standardisation costly and slow.

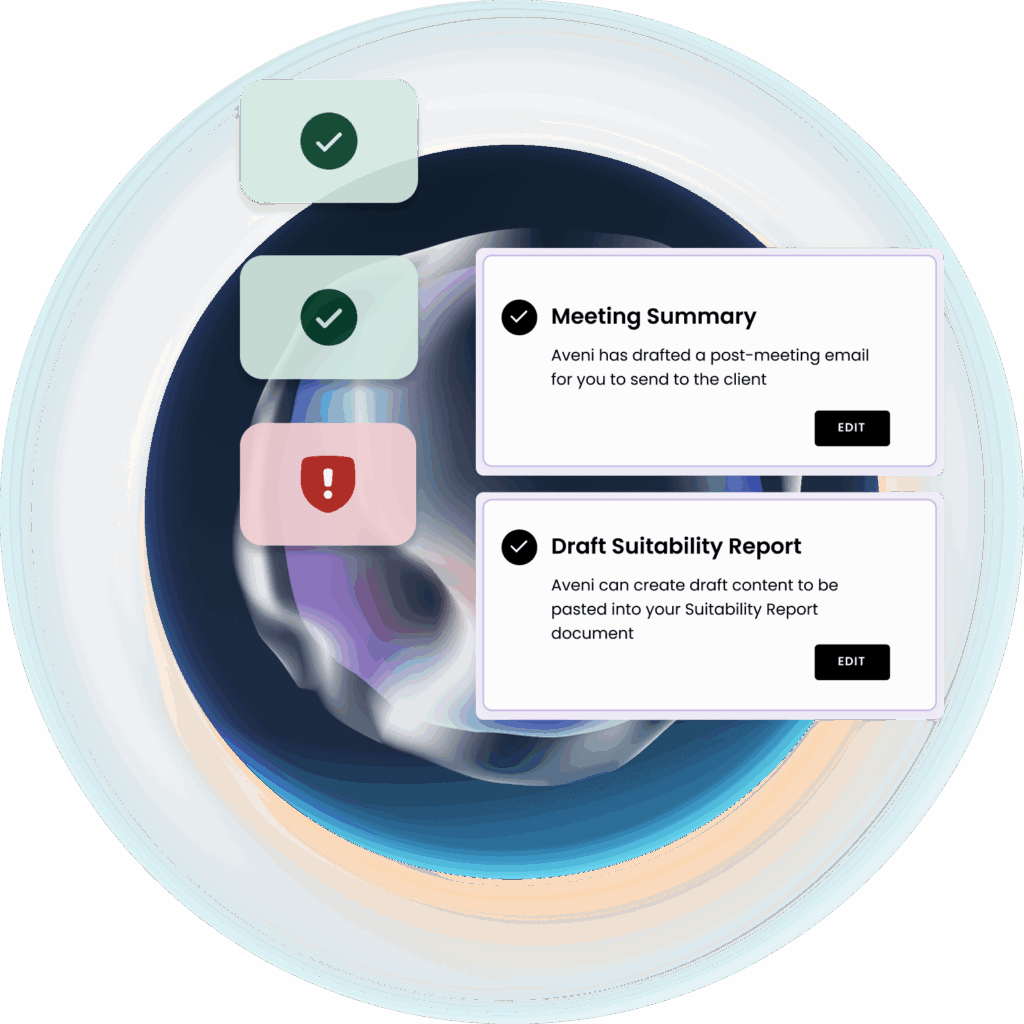

It embeds directly into adviser workflows to cut admin, standardise documentation, and deliver centralised risk oversight, without the need for wholesale CRM replacement.

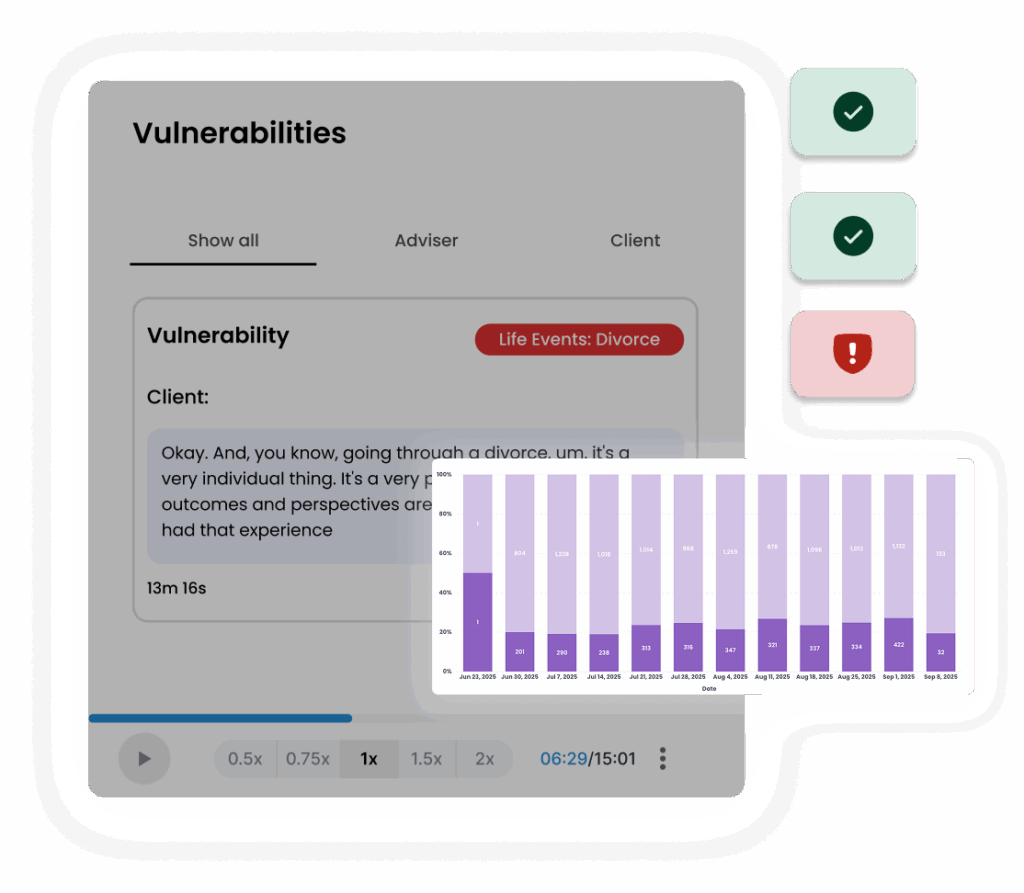

Acquisitions bring diverse processes and documentation standards. Consolidators need a consistent model to scale effectively.

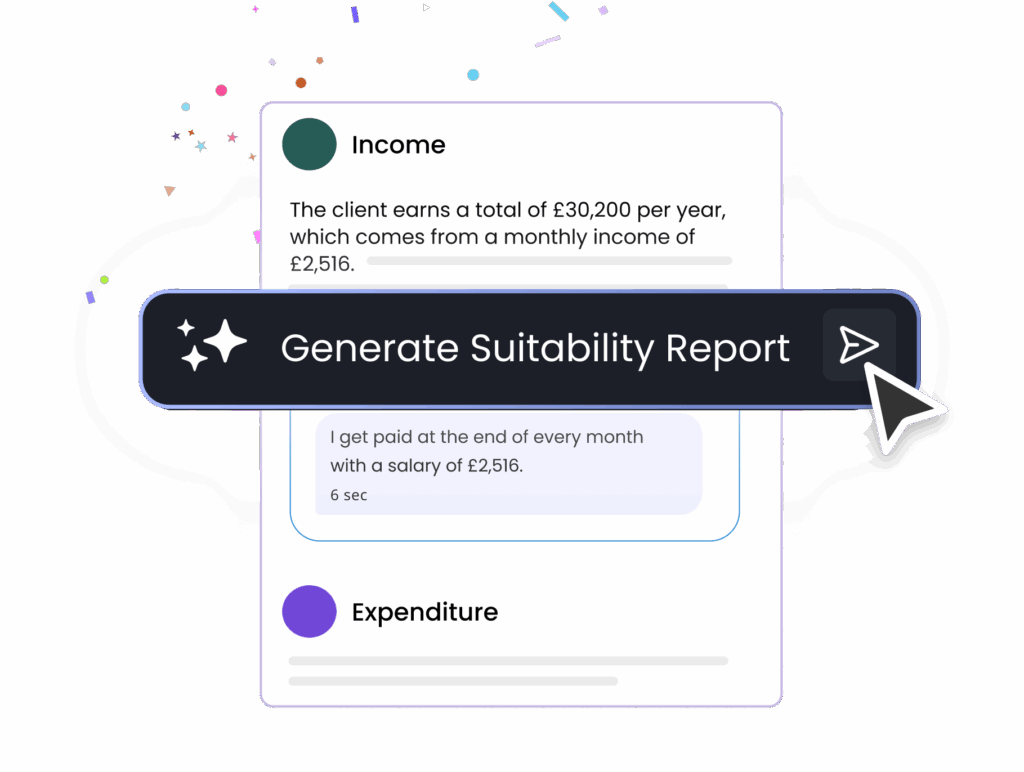

Manual adviser admin and compliance checks increase costs as the business grows. Automation is essential to scale profitably.

Multiple adviser systems slow down consolidation and create inefficiencies. Consolidators must unify workflows without disrupting advisers.

Consolidators are judged on their ability to increase efficiency and margins across acquired firms, requiring embedded tools that deliver quick wins.

ROI in weeks through adviser admin automation and scaled QA

Helps unify operations across diverse acquired firms.

Proven with national wealth and consolidator businesses in the UK

AI built for regulated financial services, aligned to FCA standards

Embeds into adviser workflows to create operational leverage without major system overhauls

Consolidators succeed by driving efficiency and scale, but that’s impossible without standardised, repeatable workflows. Aveni embeds directly into adviser processes, cutting admin, scaling QA, and delivering compliance oversight across every firm.

Streamline integration, boost margins, and deliver measurable ROI across your consolidator platform.