Consumer duty technology is becoming the foundation of compliance strategies for UK financial firms. The FCA now expects banks and wealth managers to show that advice, products and services consistently deliver good outcomes for customers. As 2026 approaches, the focus is shifting from initial implementation to continuous monitoring and evidence of improvement.

Technology plays a central role. Manual reviews and spreadsheets cannot scale to meet regulatory standards. This roadmap shows how consumer duty technology helps banks and wealth firms deliver reliable evidence while strengthening governance and efficiency.

From harm reduction to supporting customers

The FCA is placing greater weight on outcomes. Firms need to show how customers are supported across every interaction, product decision and service. Meeting this standard depends on three capabilities:

-

Monitoring all interactions, not just a small sample

-

Detecting and addressing vulnerability consistently

-

Providing boards and regulators with clear, auditable reports

AI-powered monitoring and structured reporting tools make it possible to deliver on these expectations at scale.

→ See our guide: Consumer Duty AI Tools: Complete Implementation Guide for UK Financial Services

See how Aveni Detect works in practice

What the FCA Has Said (2024–2026)

| Date / Publication | Key FCA Message / Expectation | Implication for Firms |

|---|---|---|

| July 2023 – introduction of Consumer Duty | Firms must deliver good outcomes for all retail customers, including those in vulnerable circumstances; must consider needs, characteristics and objectives of customers. (ArentFox Schiff) | Firms need to embed Duty requirements across product design, customer journeys, support and communications. |

| 2021 (and reaffirmed) – FG21/1 Vulnerability Guidance | A “vulnerable customer” may be especially susceptible to harm. Vulnerable customers must receive outcomes as good as other consumers. (FCA) | Firms should embed appropriate care, processes and support tailored to vulnerability rather than treat vulnerability as rare or exceptional. |

| 7 March 2025 – multi-firm review: “Firms’ treatment of customers in vulnerable circumstances” | FCA found mixed practices: some firms show good vulnerability support, others still deliver worse outcomes for some vulnerable customers — especially those with multiple vulnerability drivers. (FCA) | Vulnerability management must remain a priority; firms should not assume existing processes are sufficient. Continuous monitoring and outcome measurement required. |

| 30 September 2025 – “Our Consumer Duty Focus Areas for 2025–26” | FCA signals a shift from implementation to embedding the Duty; supervision will target outcomes monitoring, product design, fair value, customer journey design, consumer support, and value to customers. (FCA) | Firms should prepare for thematic reviews; embed MI (management information), audit trails, governance, and data-driven outcome measurement. |

| Late 2025 (and 2026) – forthcoming guidance & sector-specific oversight | FCA intends to provide further clarifications (e.g., for smaller consumer finance firms), and will conduct multi-firm reviews across sectors. (Skadden) | Firms should expect increasing supervisory scrutiny; need robust evidence, senior-level accountability, and adaptability to evolving guidance. |

Where technology delivers measurable outcomes

1. Vulnerability detection at scale

AI systems can review calls, chats and documents across the customer base. This ensures vulnerability is identified and logged, with evidence of the support provided.

2. Automated quality assurance

Traditional QA methods review only a fraction of cases. AI-enabled QA expands this to all interactions, reducing manual effort and providing a more accurate view of conduct and advice quality.

→ See how full-coverage QA works in practice with Aveni Detect and discover how your firm can move from sampling to complete oversight.

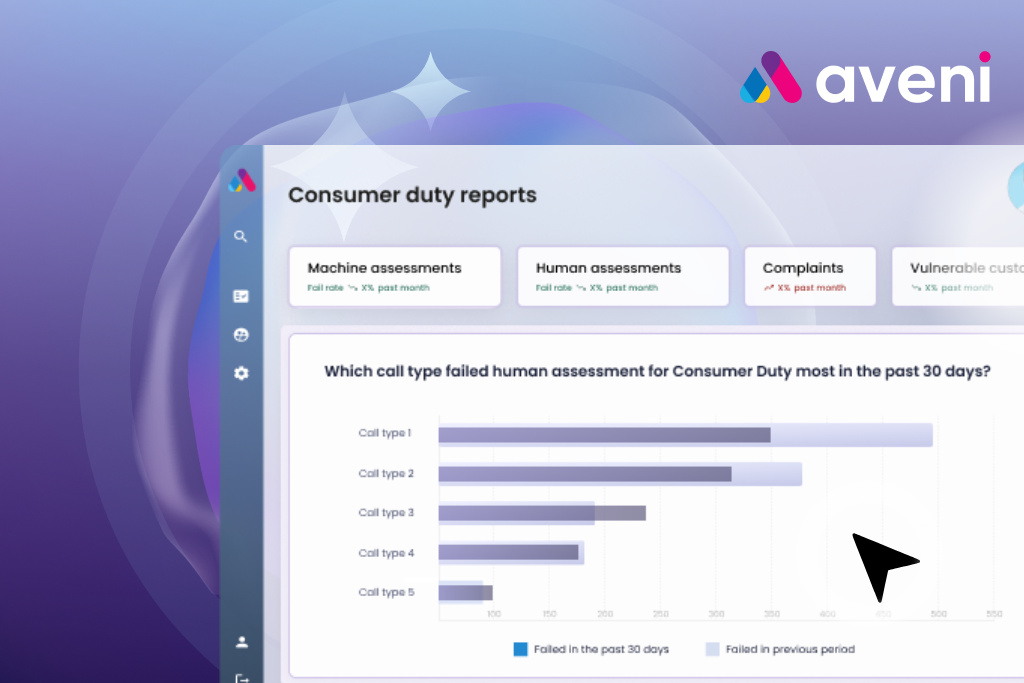

3. Management information and board reporting

Boards expect structured evidence, not anecdotes. Technology supports this with dashboards, outcome metrics and reporting packs that link decisions back to underlying data.

→ Start with our Consumer Duty Board Report Template

4. Evidence packs for regulators

Regulators want to see how monitoring is carried out and how issues are resolved. Consumer Duty technology provides full audit trails: what was reviewed, how risks were flagged, and what action followed.

→ See more in AI Governance: Building Trust and Compliance in Financial Services

Guardrails that protect firms and customers

AI must be controlled and transparent. Effective safeguards include:

-

Templates and disclosures locked for approval

-

Role-based permissions to protect sensitive data

-

Human reviews for high-risk cases

-

Ongoing fairness and bias checks

→ Practical approaches are outlined in AI Guardrails and Monitoring That Actually Work in Financial Services

Responsible adoption builds trust

Firms are expected to understand and document how their AI tools work. This includes data quality checks, model governance and oversight of third-party providers. Transparent adoption is essential to avoid regulatory or reputational risk.

The FinLLM Safety, Ethics and Value in Financial Services whitepaper provides a framework for responsible AI use in regulated markets.

The outcomes roadmap for 2026

Firms that succeed under Consumer Duty will achieve:

-

Full monitoring of customer interactions

-

QA coverage across every case

-

Board reporting backed by data

-

Evidence packs that meet regulatory standards

-

Human oversight built into every AI process

This approach makes Consumer Duty manageable while strengthening trust and resilience.

Get regulator-ready with AI-driven monitoring

Learn how Aveni helps UK financial firms meet rising FCA and PRA standards with automated, auditable compliance.

Next step: equip your board

Boards need clear, data-driven reporting on customer outcomes. Download our Consumer Duty Board Report Template to start building evidence packs that show compliance and accountability.

Frequently Asked Questions on Consumer Duty Technology

What is consumer duty technology?

Consumer duty technology refers to digital tools, including AI monitoring systems, that help banks and wealth firms demonstrate compliance with the FCA’s Consumer Duty. These tools monitor customer interactions, detect vulnerability, automate quality assurance, and generate evidence packs for boards and regulators.

How do consumer duty monitoring tools work?

Consumer duty monitoring tools use AI to review customer calls, chats and documents in real time. They flag risks, track outcomes, and provide dashboards and reports that link compliance data directly to regulatory expectations.

Why are consumer duty AI tools important for 2026?

In 2026, the FCA expects firms to move from initial implementation to proving outcomes on an ongoing basis. AI tools give firms full coverage of interactions, faster detection of risks, and stronger evidence for audits and board reports.

What is the main shift in FCA supervision of Consumer Duty from 2025 onwards?

The FCA expects firms to show that customers receive consistently good outcomes. The focus is now on evidence, data quality and regular review rather than on implementation planning.

Do Consumer Duty requirements apply differently to vulnerable customers?

No. The Duty builds on the FCA’s vulnerability guidance. Vulnerable customers should experience outcomes that are as good as those experienced by other customers. Firms may need to provide tailored support and clearer communication.

What did the FCA find in its 2025 review of vulnerability practices?

The FCA found examples of good support but also clear gaps. Customers with multiple vulnerability factors often experience poorer outcomes. Firms need stronger oversight and more reliable evidence of the support provided.

What are the four main areas the FCA will examine during 2025 and 2026?

Product and service design, outcomes monitoring, customer journey design and consumer understanding.

What does outcomes monitoring mean under Consumer Duty?

Firms must collect relevant data that shows whether customers receive good outcomes. This includes data on product performance, complaints, vulnerable customer support, communications and value for money.

Will the FCA provide more guidance before 2026?

Yes. Additional guidance is expected for smaller firms and for specific sectors. The FCA has also signalled that multi firm reviews will continue throughout 2025 and 2026.

→ Related: Six questions every wealth management board should be asking about AI