Large national wealth management firms are built on scale. Thousands of advisers, one brand, and a promise to clients that every piece of advice meets the same standard of quality and compliance. Yet, under the FCA’s Consumer Duty, that promise is now under a microscope. Boards are being asked to prove not just intent, but evidence, that oversight, consistency, and client outcomes are real, measurable, and embedded in daily operations.

For the first time, enterprise AI offers a way to meet that challenge head-on. The conversation has moved far beyond pilots and proofs of concept. AI is moving from automating admin to asking the fundamental questions of whether Boards can operationalise intelligence itself: embedding real-time oversight, insight, and support across thousands of adviser-client interactions simultaneously.

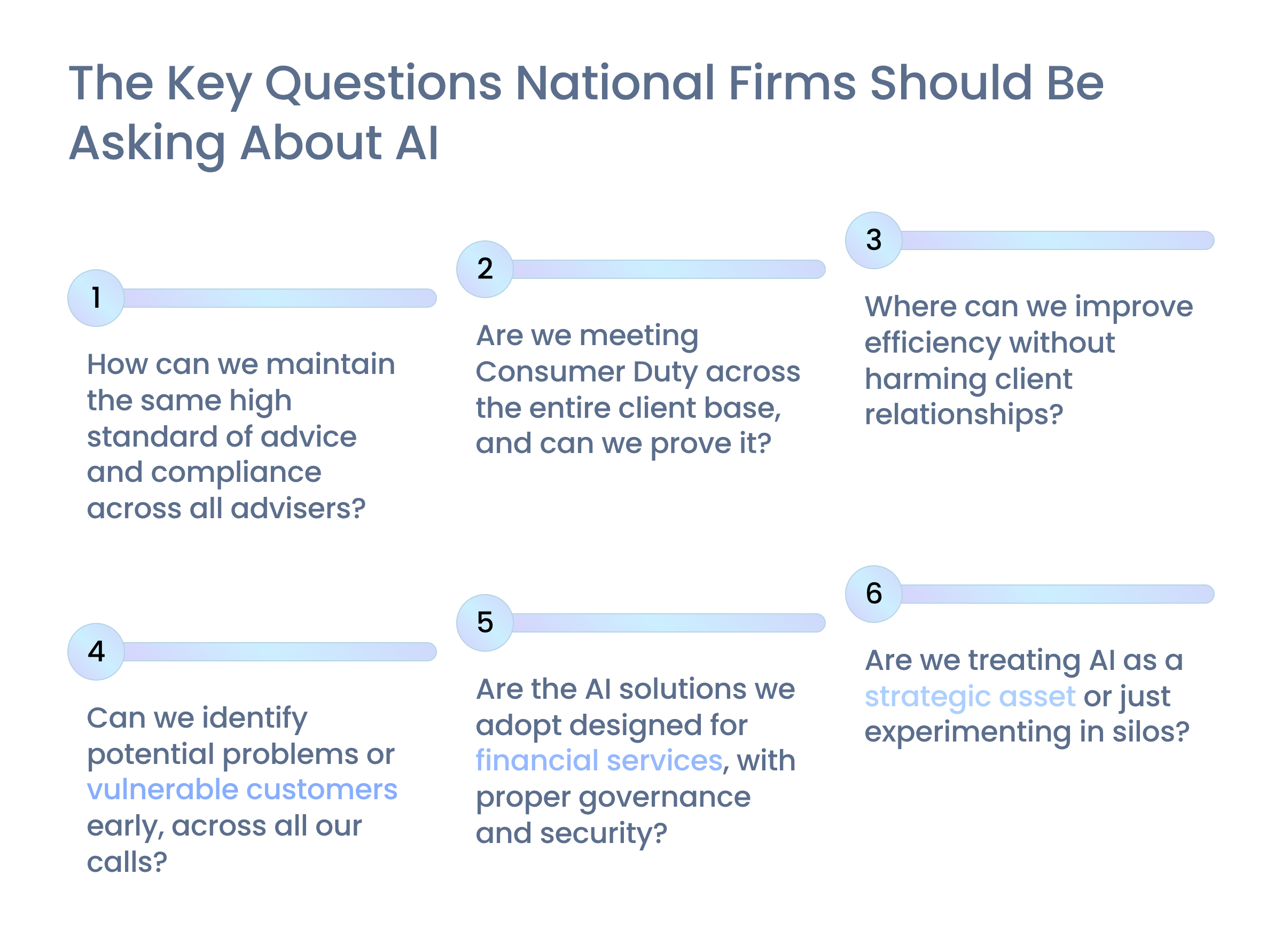

This article explores the questions that matter most for Boards right now: how to use AI responsibly to enhance advice quality, protect consumers, and demonstrate compliance at scale. And it shows how purpose-built technology like Aveni’s FinLLM is designed to make that ambition achievable.

See how Aveni works in practice

The Main Challenges for National Wealth Firms

- How to make advice quality truly consistent when every client conversation is unique

- How do you turn Consumer Duty from a compliance exercise into an evidential framework that proves fair value and good outcomes at scale?

- Finding efficiency gains that protect margins whilst preserving the personal relationships clients value

- Identifying customer vulnerabilities and early warning signals across thousands of conversations before they become problems

Below, we explore each challenge and the questions Boards need to raise.

Consistent Advice Quality Across Thousands of Advisers

Board Question: How can we maintain the same high standard of advice and compliance across all advisers?

Different advisers bring different styles and interpretations of compliance. The FCA has found ongoing advice issues across significant numbers of firms, highlighting how variance in adviser approach can create regulatory exposure. Without strong oversight, advice quality can vary, leaving firms open to regulatory risk and reputational damage.

AI as the Answer:

AI can give Boards something they have never truly had before: line of sight across every client conversation. With AI and the right data and governance, it becomes possible to understand not just whether advisers are compliant, but how consistently they interpret and apply advice principles in practice. Patterns of good conduct and areas of potential risk can be identified early, long before they surface as issues in audits or client outcomes.

When designed for the realities of regulated advice, AI can capture the substance of each meeting, generate accurate documentation, and flag anomalies or potential vulnerabilities automatically. Supervisors gain a continuous stream of insight rather than a backward-looking sample, creating a more proactive and evidence-based model of oversight. The result is not automation for its own sake, but a more transparent, predictable, and accountable advice ecosystem.

Scaling Consumer Duty Compliance and Reporting

Board Question: Are we meeting Consumer Duty across the entire client base, and can we prove it?

The FCA now requires firms to show they deliver good outcomes, treat vulnerable customers fairly, and communicate clearly. For a national firm handling thousands of meetings each week, manual reviews cannot keep up. Boards must be confident that every interaction is monitored and that evidence is ready for regulators.

AI as the Answer:

AI-enabled monitoring is fast becoming an essential part of a firm’s control framework. Rather than relying on a limited number of file reviews, AI can analyse every recorded conversation, surfacing both risks and examples of good conduct. It can identify where an adviser’s explanation might have lacked clarity, where client understanding may not have been confirmed, or where a potential vulnerability was handled well.

With full coverage across client interactions, compliance oversight becomes both broader and sharper. Review cycles shorten from weeks to hours, and emerging issues can be escalated before they pose regulatory or reputational risk. The data generated through these systems also creates a living evidence base: clear, auditable records that demonstrate Consumer Duty outcomes in practice. What was once a reactive compliance burden becomes an active source of assurance and learning for the whole organisation.

See how AI-powered monitoring delivers 100% oversight in this case study →

Efficiency Gains Without Losing the Personal Touch

Board Question: Where can we improve efficiency without harming client relationships?

Wealth management is people-driven. Clients value trust and personal service. Yet national firms must also find efficiency gains to protect margins. The challenge is to improve productivity without weakening the client experience.

AI as the Answer:

The right AI tools take on administrative work so advisers can focus on clients. For instance, one UK wealth firm used the AI assistant, Aveni Assist, to cut post-meeting admin time from two hours to 45 minutes per adviser. Tasks such as note-taking, CRM updates, and drafting reports are completed in minutes, with compliance checks built in.

Across a network of 200 advisers, this translated to 15,000 hours saved each year, worth roughly £450,000 in efficiency gains. Crucially, the time went back to advisers, who could spend it strengthening client relationships. Rather than replacing the human touch, AI enhances it by giving advisers more time and headspace for client needs.

Resource:

» Aveni’s Consumer Duty board report template

Early Detection of Customer Vulnerabilities and Risks

Board Question: Can we identify potential problems or vulnerable customers early, across all our calls?

In any large client base, some customers are vulnerable due to age, health, or financial stress. Others may give early signs of dissatisfaction or risk. If these signals are missed, outcomes suffer and compliance risks increase. Boards need assurance that red flags will not be overlooked.

AI as the Answer:

AI systems excel at scanning large volumes of unstructured data, such as call transcripts. They can detect indicators of vulnerability, confusion, or dissatisfaction, then alert managers quickly.

Aveni’s platform uses financial-services-trained AI to pick up on subtle cues such as tone, keywords, or missed disclosures. Some firms have achieved 100% complaint detection by using AI to monitor interactions. Instead of finding problems months later, issues can be identified and addressed within days, protecting both customers and the firm.

→ See how leading advice networks are cutting file review times from hours to minutes with AI

Purpose-Built AI vs. Generic Tools

Board Question: Are the AI solutions we adopt designed for financial services, with proper governance and security?

Generic AI tools are widely available, but they often fall short on compliance, auditability, and data security. Risks include opaque outputs, missing audit trails, and data being processed outside approved jurisdictions. It is no surprise that most enterprise security teams worry about sensitive data leaking through consumer-grade AI.

AI as the Answer:

Boards should insist on industry-specific AI. Aveni’s FinLLM, for example, is the UK’s first large language model designed for financial services. It has financial domain expertise, full auditability, and strong data protections, including UK data residency and encryption.

With a purpose-built solution, outputs can be traced back to source data, compliance rules are baked in, and customer data stays secure. These safeguards are critical for a regulated industry. Generic tools may seem appealing, but they are rarely acceptable in practice especially for enterprise ai in wealth management.

→ See how private banks are balancing trust and oversight with AI

From Pilots to Enterprise-Wide Oversight

Board Question: Are we treating AI as a strategic asset or just experimenting in silos?

Many firms have tested AI in narrow use cases. But the real value comes from scaling across the enterprise. Boards should ask how AI can support client onboarding, note-taking, compliance checks, and risk management together, under one strategy.

AI as the Answer:

A unified platform approach brings the benefits of scale. Aveni Assist and Aveni Detect can handle documentation and compliance monitoring in parallel, all under a central governance framework.

These systems plug into existing infrastructure, so firms can move from pilot to enterprise adoption without disruption. The payoff is significant: AI can cut admin, expand QA from 1% to 100%, and strengthen compliance oversight across every client interaction. Firms that adopt this approach often see ROI within weeks, along with clear improvements in efficiency and risk control.

→ See the The CFO’s Guide to AI ROI Measurement: Proving Value Before Your 2026 Budget

Conclusion: A Strategic Imperative for Boards

Enterprise AI is already delivering value in wealth management. From consistent advice quality to full Consumer Duty oversight, AI helps firms handle scale and complexity while also improving efficiency and client satisfaction.

The priority for Boards is to push for purpose-built, financial-services-specific solutions rather than generic tools. By asking the right questions and setting a clear vision, Boards can ensure AI adoption is both safe and strategic.

Firms that act now will gain an advantage in oversight, agility, and client trust. The conversation is not “Should we use AI?” but “How do we use AI across the business to raise our game?”

→ Discover the steps for financial firms should take in order to drive proper adviser AI adoption

Take the Next Step for Enterprise AI in Wealth Management

If you are ready to see how enterprise AI could transform oversight and operations in your firm, book a demo or strategy discussion with our team. We will show you how an AI platform built for financial services can deliver consistent oversight, boost efficiency, and support advisers in providing the best for clients.

The era of enterprise AI in wealth management has arrived. The question is whether your firm will lead or follow.

See how enterprise AI in wealth management works in practice