Artificial intelligence (AI) is transforming almost every sector of the world, and the finance industry is no exception. From robo-advisors to algorithmic trading to chatbots answering customer questions, AI is making major inroads in financial services.

However, not all AI is created equal, particularly not when it comes to our finances. We’ll be deep diving into the key difference between generic AI and financial services specific AI.

The promise and perils of generic AI

We all know and have probably used a brand of generic generative AI, even if we don’t realise it.

Generative AI (GenAI) is a type of artificial intelligence that can create new content, including texts, images, audio, videos, and code. It does this by learning the patterns and relationships in data, then using that information to generate new examples that are similar but not identical to the data it was trained on.

In the form of chatbots like ChatGPT, they are designed to be a broad, all-purpose AI assistant. They learn from vast datasets scraped from the internet and beyond, in order to generate human-like responses on almost every topic.

The results are often coherent and helpful. But can they directly translate into effectively managing financial services data or creating sound investment strategies?

Honestly? Yes and no.

The main issue is that generative AI lacks the rigour and governance required to operate safely in such a heavily regulated, high-stakes sector.

Broad to bespoke: financial services specific AI

So what is domain specific generative AI and how is it any different?

It’s AI that’s purpose-built for a particular industry, leveraging curated datasets unique to that area of interest. Its primary focus is to solve problems and drive insight relevant to that sector. In our case, that’s financial services.

FS specific GenAI focuses less on replicating language generation and more on number crunching, automating processes, supporting risk management, and contributing to overall enhanced performance for the industry.

These systems are meticulously trained and validated under regulatory supervision to ensure fairness, transparency, and compliance.

Unlike a generic chatbot, these models are carefully audited for biases that could negatively impact lending decisions, investment recommendations and insurance pricing, all of which could have lasting real-world implications.

Generic solutions fit and the bigger picture

Should we dump generic AI from financial services?

Not necessarily. Tools like ChatGPT could aid investment research, processing earnings calls, analysing sentiment, and other “soft skill” tasks. These applications can support professionals in the financial services sector, assisting in surface-level information processing and analysis.

However, they generally lack the trustworthiness to directly handle core financial matters or adequately advise clients. The complexity and sensitivity of the industry demands a higher level of reliability and precision than these tools currently offer. Strict governance is required, and outputs should be viewed as cues for further analysis rather than outright recommendations.

The risks are simply higher within financial services if AI is deployed recklessly, but the rewards can also be greater if implemented with due care. Determining the appropriate applications for both generic and specialised AI will allow financial institutions to harness an AI’s strengths while safeguarding against its shortcomings.

The key is recognising their fundamental differences.

We did the hard work so you don’t have to

We recently talked about hallucinations, which play a huge role in the trustworthiness of artificial intelligence. Hallucinations occurring in correspondence and financial advice opens both the business and the client to significant repercussions and losses.

The lack of transparency for the data that large models, like GPT, are trained on means that we have no way of really knowing what data they’re working with, or what they’re capable of creating. The models can provide outputs that seem plausible, but with no links tracing it back to its original source, can it be trusted?

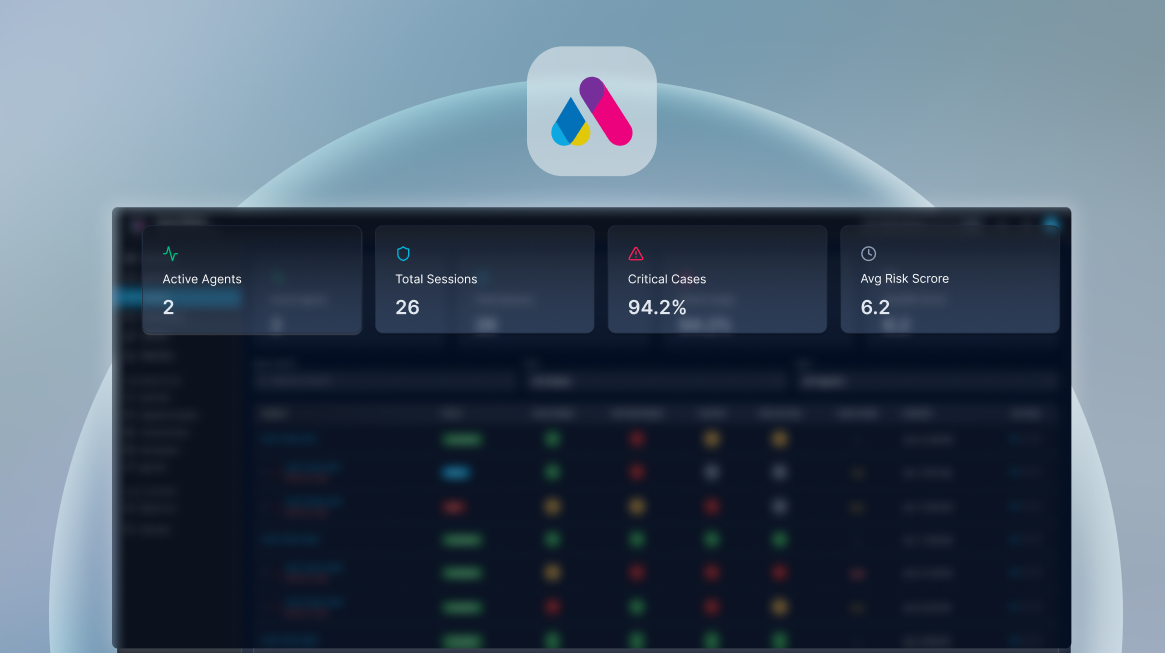

When we compared Aveni Assist, our AI assistant created specifically for the financial services industry, against generic offerings, we found some interesting things.

When it came to follow up email generation, Aveni Assist generated one without user prompting and showed little to no hallucinations. Yet most of the generic competitors had to be prompted to generate a follow-up email, with one in particular listing unhelpful topics, missed action points, and hallucinations.

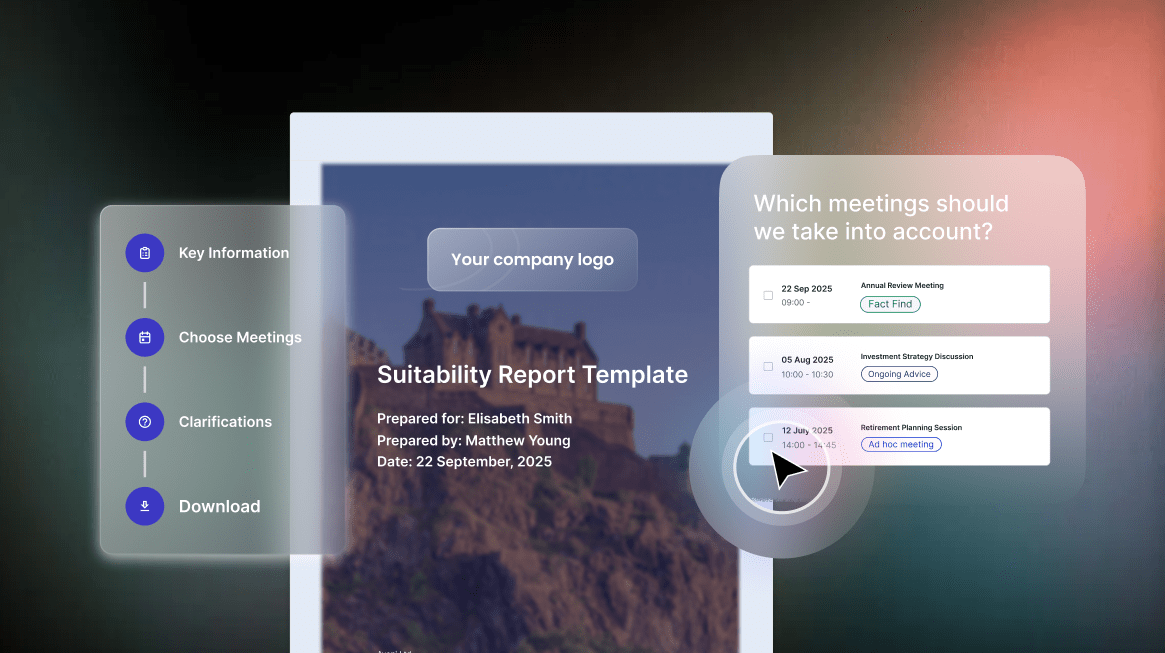

The same went for suitability reports. Aveni Assist prepared a report that focused on relevant content drawn from the client call. Generic AI offered short reports that missed key information and often included risky advice.

The future of generative AI

It goes without saying that we’re going to begin to see models turned towards specific industries and outcomes—it’s the only way we’re going to see progression in AI performance.

But whichever you choose to use, there are benefits to both larger models and financial services specific AI. As long as you’re doing your due diligence, and keeping in mind the limitations and risk.

Want to learn more about generic and financial services specific AI? Check out our webinar, which brings our expert research into real world situations.