Call recording compliance is now central to financial services. Every conversation between adviser and client must be captured, stored, and evidenced. Without a clear and complete record, advice can be challenged, regulators can raise concerns, and customer trust can suffer. The old phrase still applies: if it wasn’t recorded, it wasn’t said.

Today, the difference is how technology makes this possible. Aveni’s products now capture, analyse, and transform adviser-client interactions into evidence that is complete, auditable, and ready for compliance review.

The Compliance Pressure

Consumer Duty has raised the bar. Boards now need to show that advisers communicated clearly, avoided jargon, checked client understanding, and delivered fair value. Relying on handwritten notes or disjointed systems is no longer enough. Firms need evidence that is consistent across every adviser, every call, and every document.

Recording Is Just the Start

Capturing the conversation is only step one. What firms need is a way to:

-

Store and surface conversations securely.

-

Generate compliant documents that reflect the whole advice journey.

-

Monitor adviser behaviour against Consumer Duty standards.

-

Provide board-level reporting that demonstrates oversight.

This is where Aveni Assist and Aveni Detect now work hand in hand.

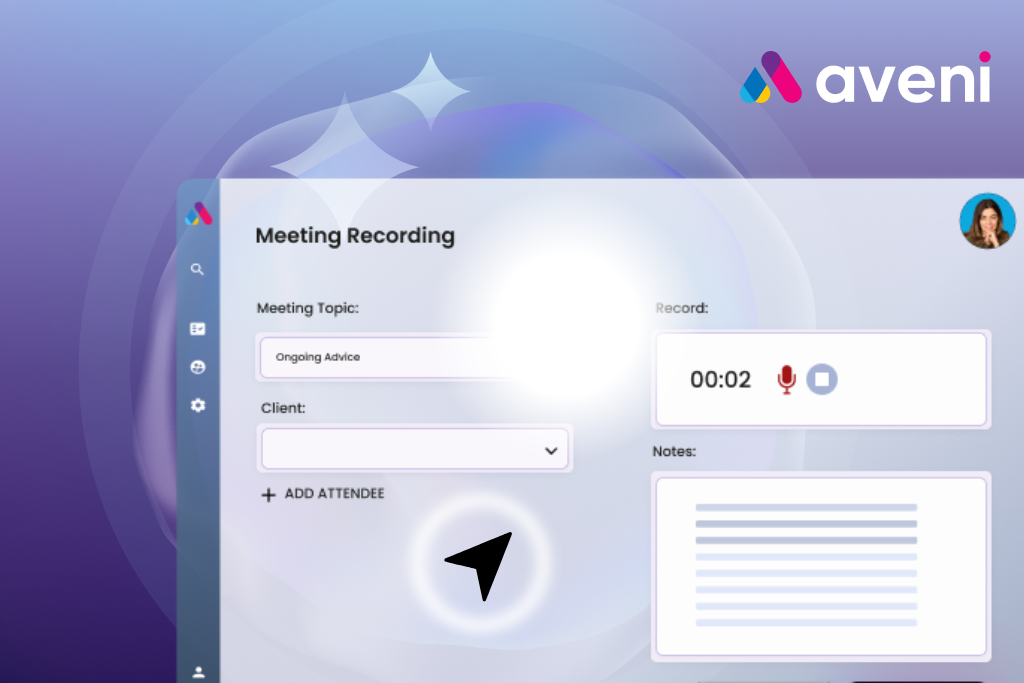

Aveni Assist: End-to-End Adviser Workflow

Aveni Assist is more than a meeting assistant. It powers the adviser workflow before, during, and after client meetings:

-

Real-time capture: Meetings are transcribed and summarised, with objectives, preferences, and fact find data extracted automatically.

-

Document generation: Suitability Reports, Provider letters, Client letters, and Annual Reviews are created in minutes, not hours. Assist combines CRM records, meeting notes, fact finds, and risk profiles into Word templates you already use. No rebuilds, no macros, no extra setup.

-

Fact Find enhancements: Data is pushed directly into systems like Intelliflo Office and Xplan, cutting manual entry and reducing errors.

-

Compliance built-in: Clarification prompts flag missing or unclear information before documents are finalised, helping firms evidence Consumer Duty outcomes.

-

Human oversight: Advisers stay in control, reviewing drafts before delivery to clients.

The result: faster turnaround, fewer errors, and more time for client engagement.

Aveni Detect: Turning Records Into Compliance Intelligence

Recording client conversations is vital, but Detect goes further. Its new dashboards transform raw analysis into actionable compliance evidence:

-

Standardised Consumer Duty reporting with out-of-the-box metrics.

-

Vulnerability and complaints dashboards for early risk detection.

-

Clear performance benchmarking across advisers and teams.

-

Exportable, regulator-ready reports in just a few clicks.

For boards, this means they can demonstrate oversight with confidence and respond quickly to any regulatory review.

Innovation Beyond Today’s Products

Alongside Assist and Detect, Aveni is also developing FinLLM, a finance-specific large language model being built in partnership with leading UK banks. FinLLM signals the next phase of AI in financial services: tools designed from the ground up for compliance, accuracy, and sector-specific needs.

Why This Matters for Firms

Accurate records are now the foundation of compliance and client trust. With Aveni:

-

Compliance teams gain regulator-ready reports.

-

Advisers and paraplanners save hours of admin every week.

-

Boards receive clear, digestible insights on Consumer Duty outcomes.

-

Clients see advice that is transparent, personalised, and trustworthy.

Recording conversations is only part of the story. What matters is how those records are turned into evidence, documents, and oversight that meet the standards of Consumer Duty.

With Aveni Assist and Aveni Detect, firms can finally close the gap: every word captured, every document generated, every outcome evidenced.

Book a demo to see how Aveni helps firms secure every client interaction.