Generate suitability reports, update CRM records, and create client emails in minutes, not hours. Built specifically for UK financial advisers.

From suitability reports to CRM updates, Aveni Assist brings productivity, compliance, flexibility, and ease of use into one seamless workflow.

"7IM is a business that has a long history of putting its clients first by staying at the forefront of technological innovation. This approach is reflected in the choice to partner with Aveni for strategic AI adoption."

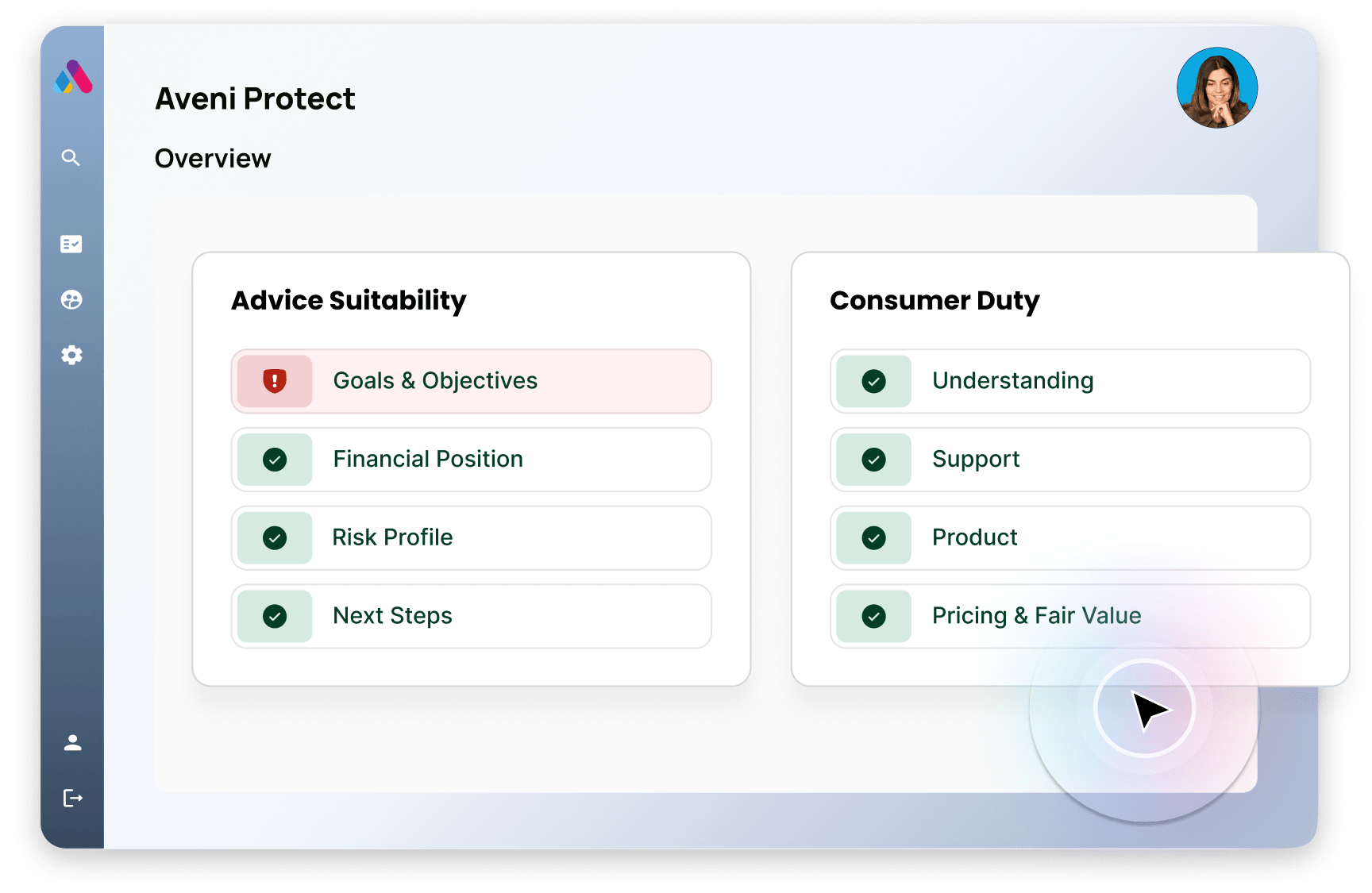

“Aveni Detect is already helping us to support quality assurance across our customer interactions and helping to identify customer vulnerabilities and enhance our support mode.”

“We have seen really positive feedback from our team, response to the Aveni Assist tool has been excellent and we are very pleased with the results and business impact so far. We’ve been really well supported by Aveni as we have gone through this process.”

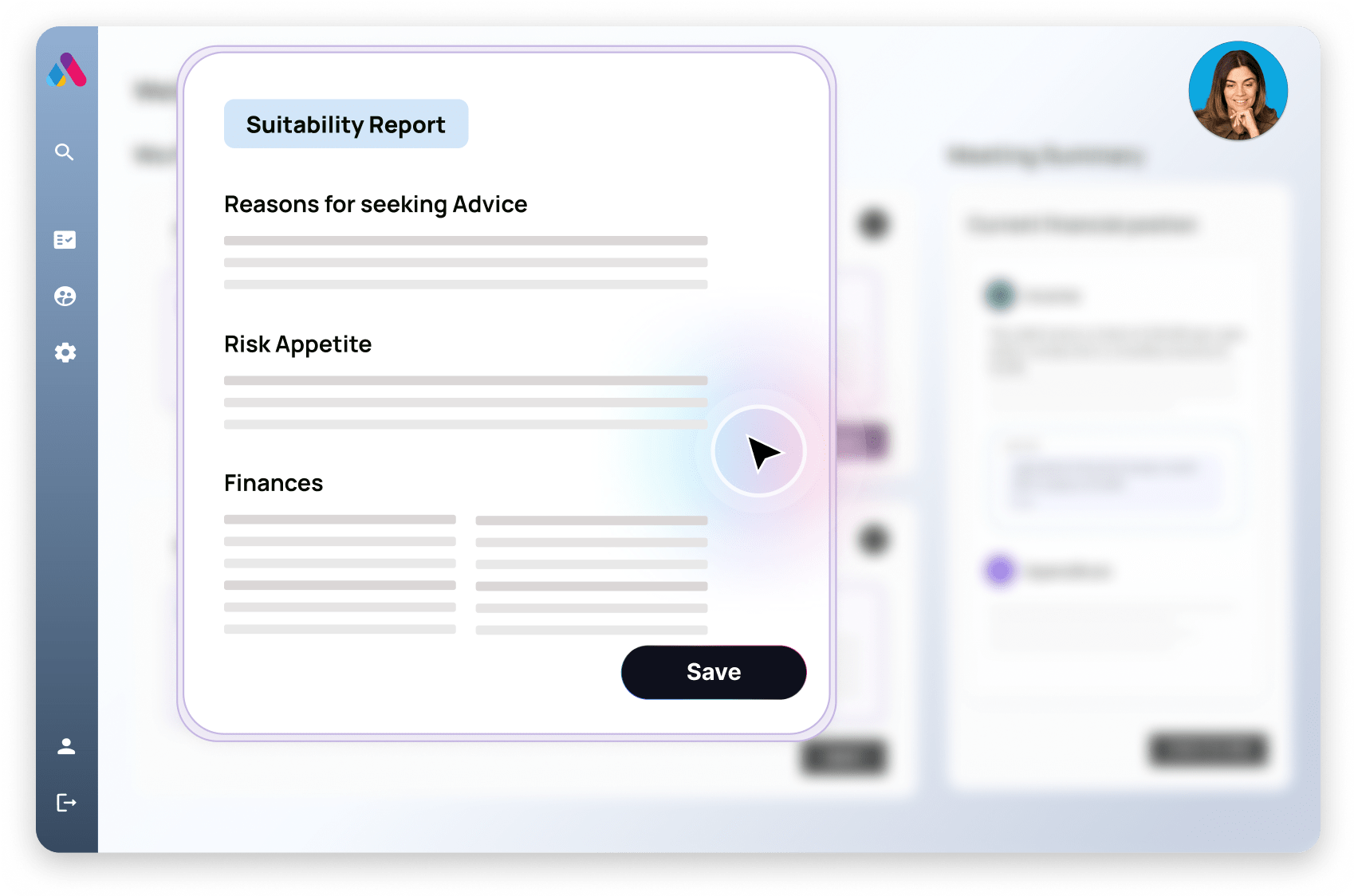

“This technology has the capability to substantially reduce the administrative burden on advisers, freeing them up to devote more time to meeting their clients’ needs.”

“At Octopus Money, we’re always looking for ways to ensure every customer gets the money support they need - not just the wealthiest few. Aveni’s solutions are helping us digitise and streamline our customer call reviews, ensuring we maintain the highest standards while reducing the time spent on manual processes.”

“Our partnership with Aveni shows our commitment to using technology to ensure the quality of our advice. Aveni Detect enables us to identify vulnerable and other high risk clients, helping us support them in the best possible way.”

“Aveni Detects allows our Risk, Compliance and Quality teams to have much more oversight of the entire business, using the same resource but focused on areas that add the most value to our clients and the business along with assurance to myself, the rest of the Board and the regulator.”

Aveni Assist helps insurance brokers maximise productivity by automating admin tasks, surfacing next-best actions, and streamlining client follow-ups—freeing advisers to focus on value-driven conversations. Advisers often juggle complex policies and strict scripts under pressure. Aveni Assist helps ensure key disclosures are made, terms are explained clearly, and customer trust stays intact.

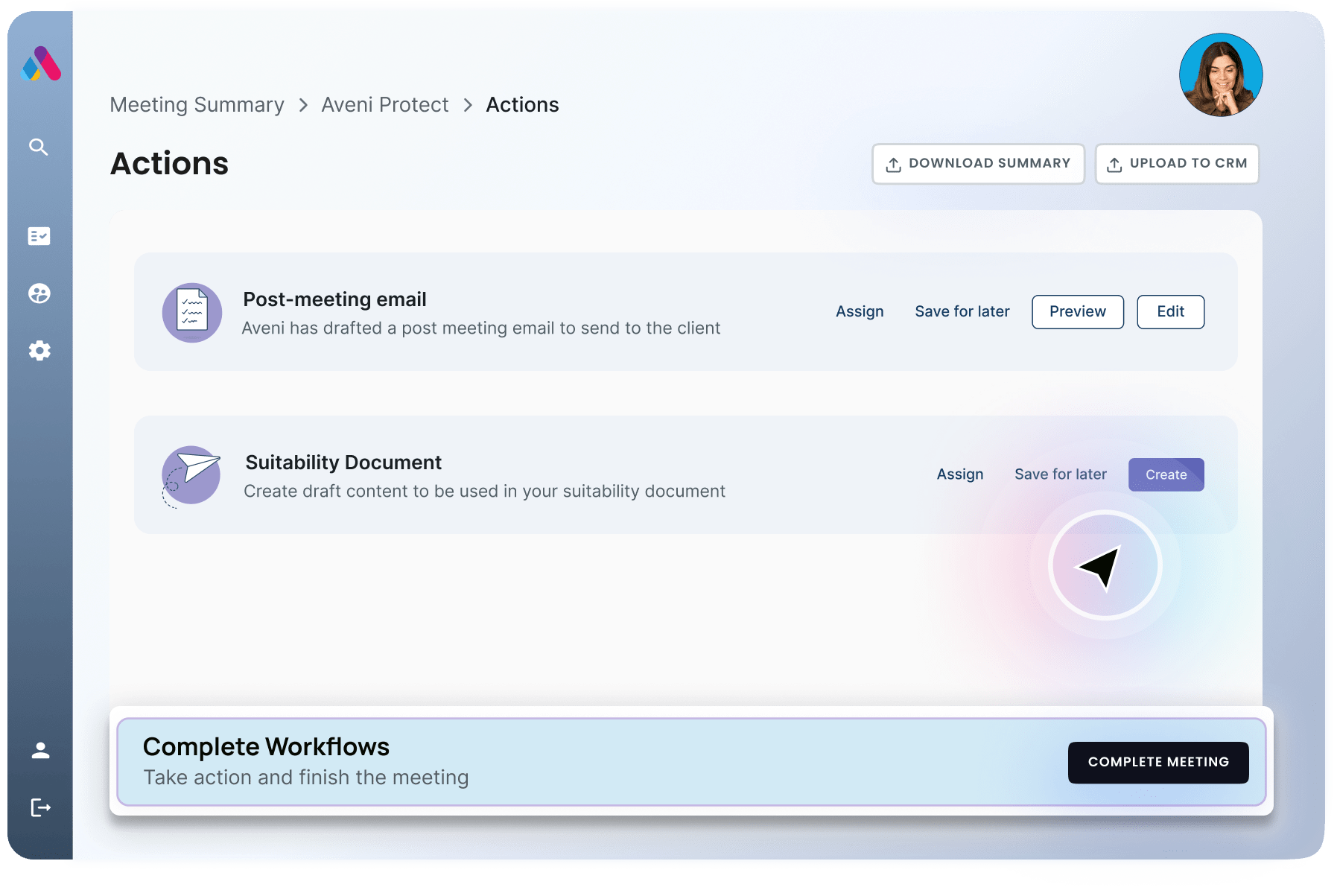

Conversations around risk, returns and suitability are high-stakes. Aveni Assist gives wealth managers more time to deliver personalised, high-quality advice. By summarising meetings, tracking client commitments, generating suitability reports, and suggesting timely actions, Assist cuts through manual work.

Advisers cover a huge range of products with variable customer understanding. Aveni Assist helps banks make advice clearer, safer and more consistent. The platform automatically captures key insights, drafts summaries, and recommends follow-up actions—improving customer journeys and operational efficiency.

FINANCIAL ADVICE CONSUMER SURVEY FINDINGS