Beyond Placeholders: Automated Document Generation for Financial Advice

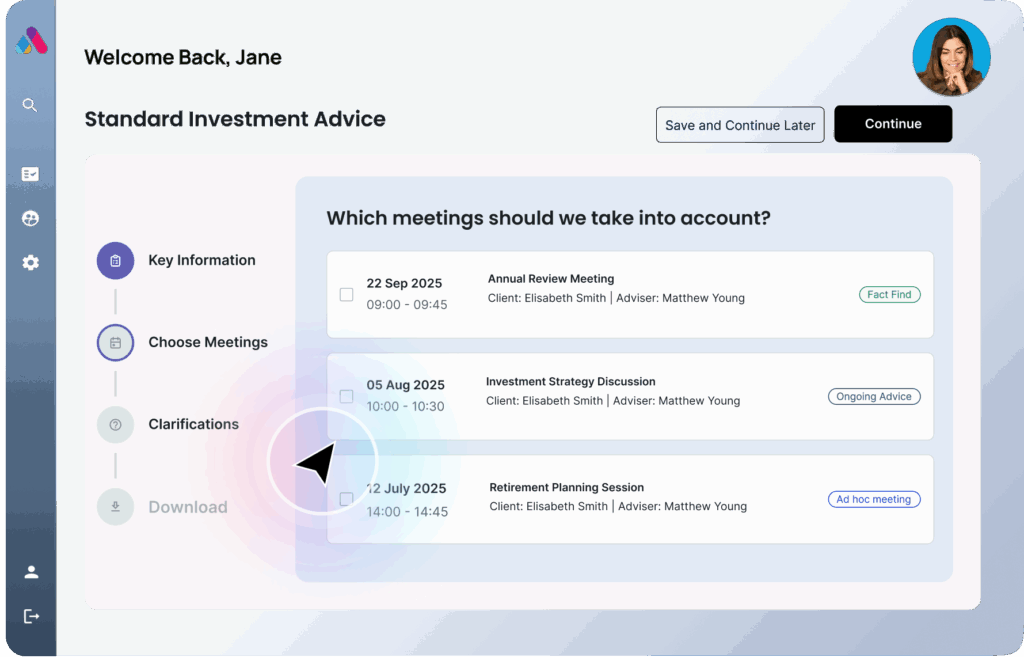

Suitability reports consume hours of adviser time every week. While most automation tools simply fill template placeholders, advisers still face the real bottleneck: assembling scattered information from CRMs, meeting notes, fact finds, and risk profiles into coherent, compliant documents.

Paraplanners and advisers typically spend considerable time manually crafting each report, pulling information from multiple meetings, systems, and documents. This process is repetitive, error-prone, and a major productivity bottleneck for advice firms.

Aveni Assist takes a different approach. Built specifically for regulated advice workflows, it combines data from across the client lifecycle, working directly with your existing Word templates to produce documents that are fast to create, easy to review, and compliance-ready.

→ See how Aveni Assist powers compliance-ready document generation

FCA Consumer Duty and the demand for compliant documents

FCA Consumer Duty and the demand for compliant documents

Firms face mounting pressure from the FCA to evidence good outcomes under Consumer Duty while maintaining responsive client service. Manual document production creates delays in both areas. Automation addresses these twin pressures by:

- Reducing preparation time: Annual review reports created in minutes instead of hours

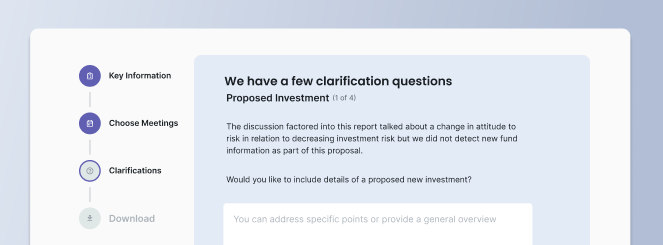

- Improving compliance oversight: Built-in clarification prompts highlight gaps before reports are finalised

- Enhancing client trust: Each document is tailored, auditable, and transparent

- Scaling adviser capacity: More time with clients, less on administrative tasks

The FCA expects firms to demonstrate suitability through clear, client-specific documentation. Generic template outputs often fall short of these regulatory expectations, particularly under Consumer Duty requirements.

Technical integration for real advice workflows

Most document automation tools work in isolation from advice workflows. Aveni Assist integrates directly with the systems advisers use daily:

Multi-source data integration: Connects to Intelliflo Office and Xplan CRMs, plus meeting summaries, fact finds, and risk profiles. All data sources combine into a single, coherent output without manual copy-pasting.

True personalisation at scale: Produces reports tailored to individual clients, including joint cases, without repetitive manual editing. The system uses multiple input sources to create highly personalised reports that exceed regulatory expectations.

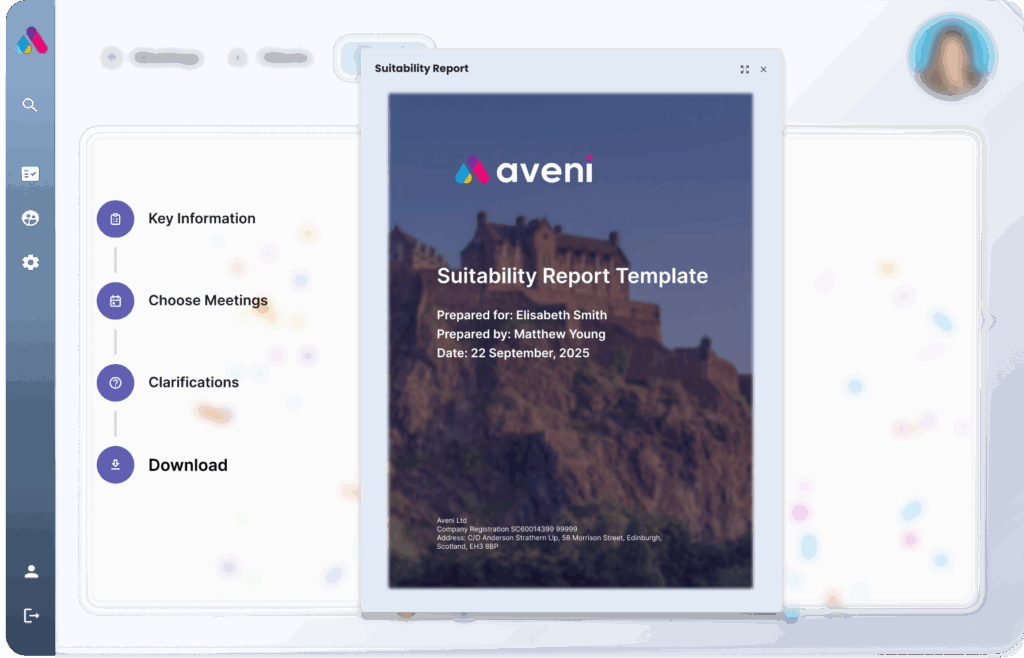

Template control: Works with your existing Word documents. No macros, no expensive setup, no brand compromises. Upload your template and receive completed Word documents back.

Compliance safeguards: Built-in prompts flag missing or unclear information before finalisation, helping firms evidence Consumer Duty standards and suitability requirements.

How Aveni Assist differs from standard automation

Many document tools in financial services operate as basic template fillers. They require rebuilding templates in proprietary editors or output generic text that still requires hours of manual editing.

| Feature | Aveni Assist | Basic Template Tools |

|---|---|---|

| Template control | Uses your existing Word templates, no macros or rebuilds needed | Requires new formats or setup in proprietary editor |

| Integration depth | Connects to Intelliflo Office, Xplan, meeting summaries, fact finds, risk profiles | Limited to CRM merge fields or manual data entry |

| Client complexity | Handles single and joint client scenarios natively | Often limited to single client cases |

| Compliance checks | Built-in clarification prompts flag missing information | Generic outputs with no compliance verification |

| Review workflow | Adviser reviews and approves before delivery | Static outputs with no built-in review process |

| Enterprise scalability | Centralised control of templates, tone, and disclaimers | Fragmented, often requiring firm-by-firm setup |

This architectural difference matters for regulated environments. Other tools often add administrative overhead by operating outside the advice process. Aveni Assist builds automation directly into adviser and paraplanner workflows.

See how responsible AI architecture protects financial services firms →

Proven results from early adopters

Based on verified data from early adopters (firms anonymised for commercial sensitivity):

- Annual review “no change” reports: Reduced from 30-90 minutes to 10 minutes

- Complex fund switch reports: Cut from 90 minutes to 20 minutes

- Client turnaround time: Improved from 4-6 weeks to same-day or next-day delivery

Note: These are examples from specific client implementations and results may vary based on firm size, complexity, and implementation approach.

The time savings extend beyond individual reports. Firms report improved consistency in document quality and reduced compliance review cycles, as built-in prompts catch issues before documents reach quality assurance teams.

See the success firms achieve with automated suitability reports →

Enterprise-ready document governance

For larger advisory networks, Aveni Assist provides centralised control over document standards:

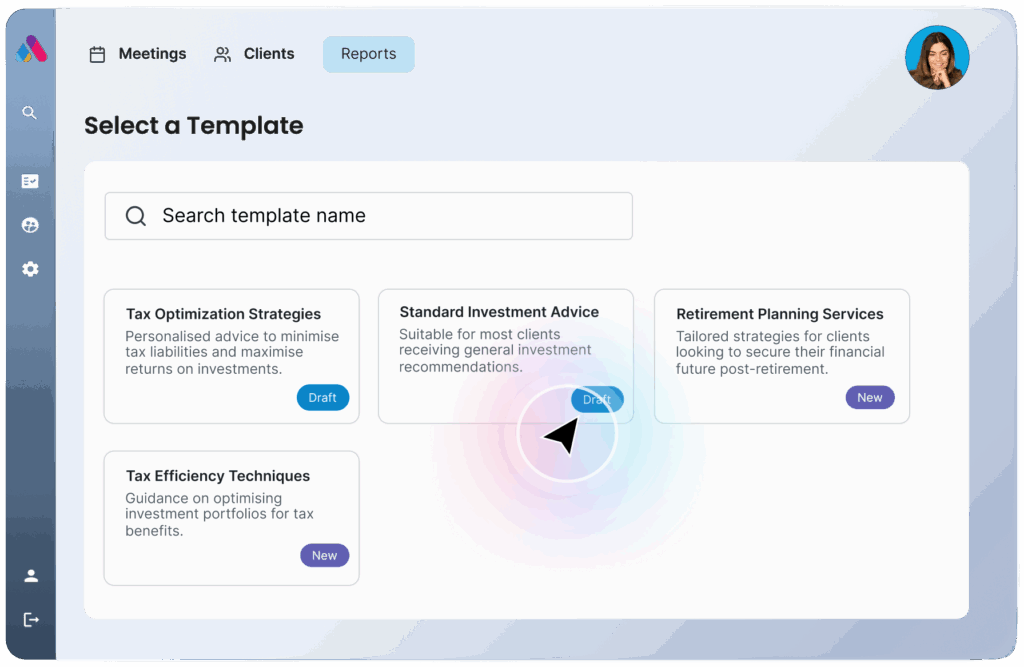

Template management: Upload, test, publish, and remove templates with full access control. Managers can ensure the right people have appropriate permissions.

Tone and compliance consistency: Centralised definition of language, structure, and disclaimers across distributed adviser teams.

Multi-adviser support: Handles high-volume document generation while maintaining quality control and compliance oversight.

Audit readiness: Every document includes source traceability and review history, supporting FCA inspection requirements.

The system scales from pilot implementations to full network rollouts without requiring lengthy IT change cycles or complex integration projects.

→ Related: Six questions every wealth management board should be asking about AI

Meeting FCA expectations

Under Consumer Duty, firms must evidence that advice is suitable and outcomes are good. Standard document automation often produces cookie-cutter reports that don’t meet these regulatory expectations.

Aveni Assist addresses FCA requirements by:

- Identifying gaps: Clarification prompts detect incomplete information and request additional detail

- Evidencing suitability: Clear, client-specific reasoning throughout reports

- Supporting vulnerable customers: Consistent application of appropriate communication standards

- Maintaining audit trails: Full traceability of information sources and adviser decisions

The interactive clarification mechanism sets a new standard in the industry, actively improving report quality rather than just automating existing processes.

Discover Aveni’s Consumer Duty compliance solutions →

Getting started with document automation

Aveni Assist is designed for immediate pilot implementation alongside existing manual processes. Firms can test the system with selected advisers and document types before broader rollout.

The implementation process mirrors current workflows: Word template in, completed Word document out. This approach reduces adoption barriers and supports rapid scaling across adviser teams.

Ready to transform your document generation process? See how Aveni Assist can help your firm create compliant, client-ready documents in minutes rather than hours.

Ready to Transform Your Document Process?

See how Aveni Assist can create compliant, client-ready documents in minutes