Choosing the right consumer duty monitoring tools should be a priority for UK financial firms. From vulnerability tracking to outcome reporting, these platforms support both compliance and customer protection. Here we compare the top options for 2025.

What Consumer Duty Monitoring Requires

Consumer Duty extends beyond call recording. The FCA expects firms to evidence four key outcomes:

- Customer Understanding – Proving customers comprehend the products and advice they receive

- Fair Value Assessment – Demonstrating products deliver value relative to cost

- Customer Support – Showing appropriate help for different customer needs

- Vulnerability Management – Identifying and protecting customers who may be at risk

Manual monitoring processes cannot deliver this evidence at scale. Consumer duty monitoring tools powered by AI provide the necessary infrastructure for Consumer Duty compliance.

Consumer Duty Monitoring Tools: Platform Categories

Conversation Intelligence Platforms

These tools analyse customer interactions to identify compliance risks, vulnerability indicators, and outcome evidence. Purpose-built financial services platforms typically offer:

- Automated quality assessment based on regulatory frameworks

- Vulnerability detection aligned to FCA guidance FG21/1

- Consumer Duty specific reporting for board oversight

- Integration capabilities with existing CRM and telephony systems

Leading platforms: Aveni Detect, Recordsure, CallMiner

Generic Contact Centre Solutions

Broader conversation analytics platforms that serve multiple industries. These focus on:

- Sentiment analysis across customer interactions

- Agent coaching and performance optimisation

- Customer experience metrics and satisfaction tracking

- Real-time monitoring capabilities

Examples: Observe.ai, Verint, NICE

Document Processing Solutions

AI systems that analyse written communications and documentation for compliance evidence:

- Email and letter analysis for Consumer Duty indicators

- Document compliance checking against regulatory requirements

- Automated report generation for audit purposes

Detailed Analysis: Financial Services Specialists

Aveni Detect

Core Capabilities:

- Purpose-built for UK financial services regulation

- 100% conversation coverage vs industry-standard 1-3% sampling

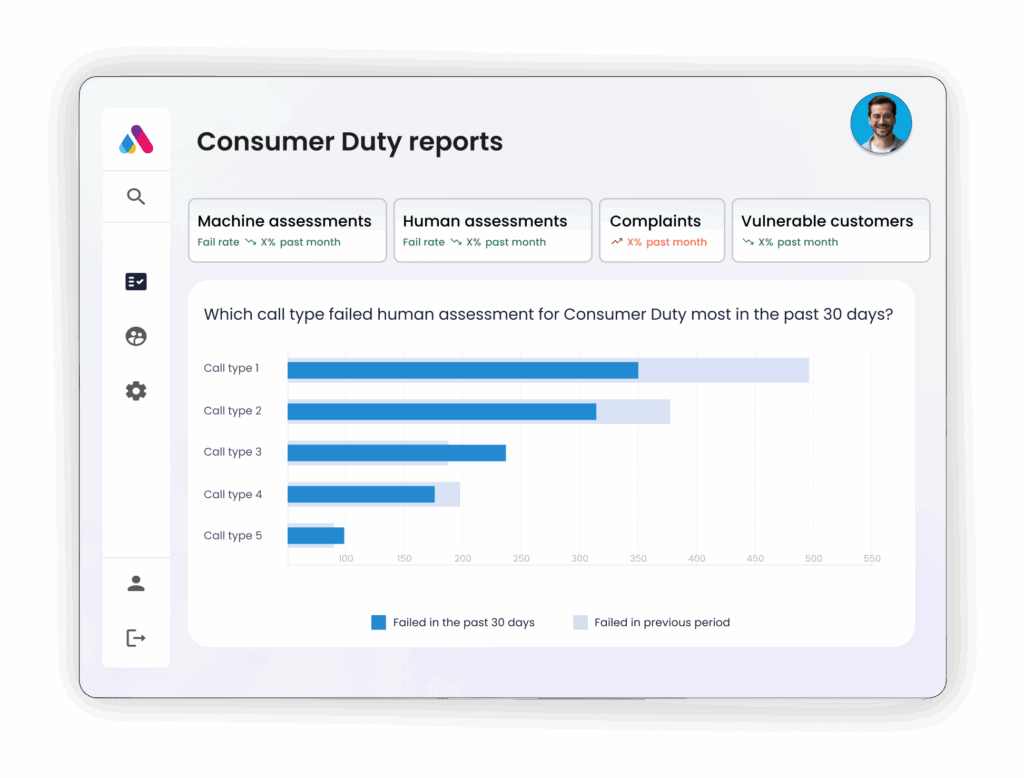

- Consumer Duty dashboard with pre-configured FCA reporting

- Vulnerability detection categories aligned to FCA FG21/1 guidance

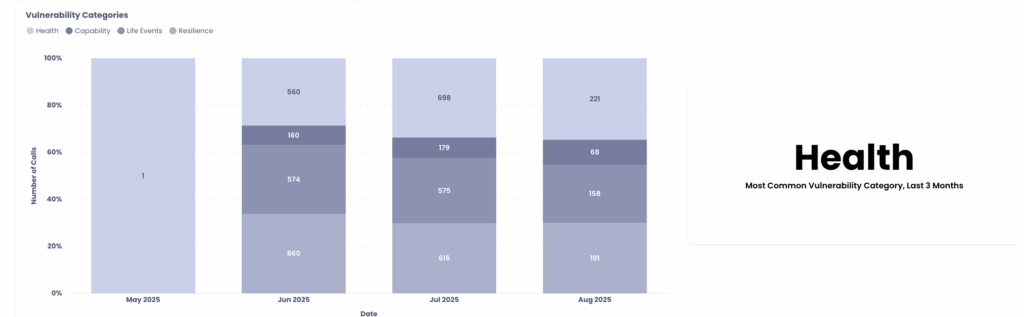

Technology Foundation: Aveni’s FinLLM technology provides financial services-specific language understanding that generic platforms cannot match. The platform automatically categorises vulnerability types across Health, Capability, Life Events, and Resilience categories.

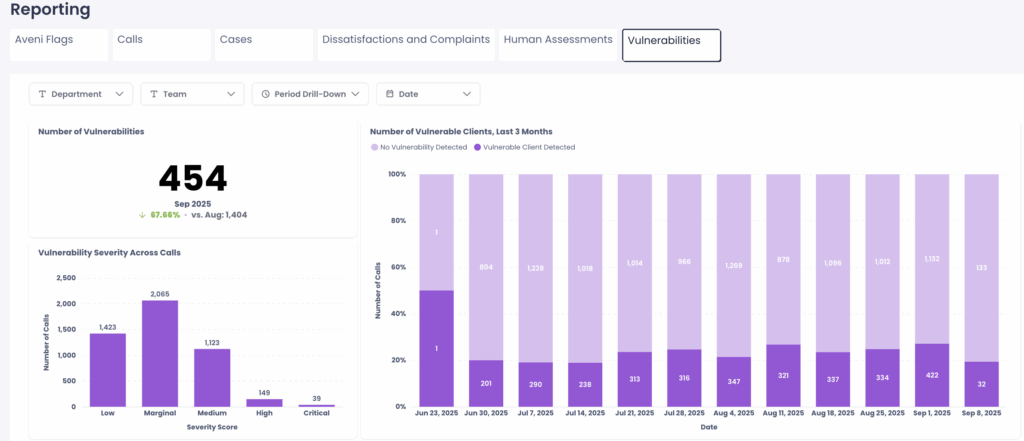

Verified Results: Key Group reduced QA process time from 90 minutes to 15 minutes per case. The platform identifies vulnerable customers automatically, with 454 vulnerabilities detected in September 2025, trending down 67.69% from the previous month.

Integration Ecosystem: Native integrations with intelliflo office, Xplan, Genesys, and major CRM platforms ensure deployment across existing tech stacks.

Learn more about enterprise-grade Consumer Duty implementation methods →

Recordsure

Core Capabilities:

- Established presence in UK wealth management

- Document analysis capabilities alongside conversation monitoring

- PowerBI integration for reporting

- 13 years of regulatory expertise

Limitations Based on Customer Feedback:

- Customer reports of challenging onboarding processes lasting 9+ months

- Limited real-time analysis capabilities

- Less comprehensive Consumer Duty specific features

CallMiner

Core Capabilities:

- Broad industry experience across multiple sectors

- Comprehensive post-call analysis capabilities

- Strong sentiment analysis features

- Established enterprise client base

Considerations:

- General-purpose platform not optimised for financial services

- Limited Consumer Duty specific functionality

- May require significant customisation for FCA compliance

Implementation Considerations

Technical Requirements

Integration Complexity: Financial services firms require integration with existing CRM systems, telephony platforms, and compliance databases. Purpose-built platforms generally offer pre-configured integrations that reduce implementation time.

Data Security: Consumer Duty monitoring involves processing sensitive customer data. Look for platforms with SOC 2 certification, GDPR compliance, and financial services-grade security controls.

Scalability: Consider both current call volumes and future growth. Cloud-native platforms handle scaling more effectively than on-premise solutions.

Measurement and ROI

Efficiency Gains: Leading implementations report 60-200% improvement in QA process speed. Aveni customers achieve sub-20 minute case reviews vs industry standard 90+ minutes.

Coverage Expansion: AI platforms enable 100% interaction monitoring vs traditional 1-3% sampling rates, providing complete Consumer Duty evidence coverage.

Risk Reduction: Comprehensive monitoring identifies compliance risks before they become regulatory issues, potentially saving significant fines and remediation costs.

Discover how AI monitoring delivers measurable Consumer Duty ROI →

Vulnerability Detection Capabilities

Consumer Duty places specific emphasis on vulnerability identification and management. The most effective AI tools provide granular vulnerability categorisation with clear audit trails.

Advanced platforms track vulnerability trends over time, enabling firms to demonstrate improving customer protection. Aveni’s platform identified temporary illness/hospitalisation as the most common vulnerability sub-category, providing actionable insights for customer support strategy.

Board-Level Reporting Requirements

Consumer Duty demands board accountability for customer outcomes. AI monitoring platforms must translate complex conversation data into executive-ready insights.

Essential board reporting features include:

- Outcome trend analysis showing improvement or deterioration over time

- Risk indicator dashboards highlighting areas requiring attention

- Comparative performance metrics across departments and advisor teams

- Regulatory compliance evidence ready for FCA scrutiny

Selection Criteria for Consumer Duty Monitoring Tools

Selecting consumer duty monitoring tools requires balancing regulatory compliance, operational efficiency, and technical integration requirements.

For Enterprise Financial Services Firms: Purpose-built platforms like Aveni Detect offer the deepest regulatory alignment and fastest implementation. The combination of 100% coverage, Consumer Duty specific reporting, and proven efficiency gains provides clear ROI justification.

For Contact Centre Operations: Broader platforms may suit firms with multi-industry operations, though customisation requirements typically increase implementation complexity and cost.

For Document-Heavy Processes: Consider platforms with strong document analysis capabilities alongside conversation monitoring for complete Consumer Duty evidence gathering.

See how leading financial services firms implement comprehensive Consumer Duty monitoring →

Implementation Path

Consumer duty monitoring tools have become regulatory infrastructure rather than optional technology. The platforms that succeed combine regulatory expertise, technical sophistication, and proven implementation track records.

When evaluating solutions, prioritise platforms that demonstrate:

- Regulatory alignment with FCA Consumer Duty requirements

- Proven efficiency gains with reference customer case studies

- Comprehensive coverage beyond traditional sampling approaches

- Integration capabilities with your existing technology ecosystem

The choice between generic conversation analytics and financial services-specific platforms determines implementation success. Purpose-built solutions consistently deliver faster deployment, deeper regulatory insights, and stronger ROI outcomes.

Explore how Aveni’s Consumer Duty monitoring delivers enterprise-scale compliance →