AI clarification prompts are becoming essential for financial advice firms facing Consumer Duty. The FCA’s bar for suitability documentation is high. Every piece of advice must be evidenced, personalised, and traceable to the original conversation. Missing detail creates risk. Rework slows turnaround. Clarification prompts fix this at the point of creation.

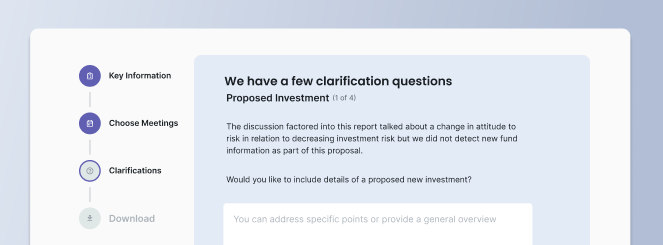

See how clarification prompts work in practice

What the regulator expects

Firms must keep records that:

- show clear rationale linked to the client’s circumstances

- trace back to meetings and source data

- stand up to audit and review

Generic templates struggle here. They often miss the “why” and the evidence.

The documentation gaps that cause trouble

Suitability reports typically fail for three reasons:

- Missing the “why” – Notes state what was discussed, not why it matters for this client.

- Features without preferences- Product features appear, but the client’s stated preferences are not captured.

- Outcome without reasoning – The recommendation is recorded, but the reasoning chain is thin.

These gaps usually come from memory and summarising after the fact.

→ See How Aveni Doc Gen Handles What Other Tools Cannot: Multi-Touch Advice Journeys

How AI clarification prompts work in practice

Aveni Assist analyses multiple sources while building the draft:

- meeting transcripts

- CRM data

- fact finds and risk profiles

- previous documents

When the AI detects unclear or incomplete information, it does not guess. It raises a targeted prompt for the adviser to confirm or clarify.

Example:

Meeting notes mention sustainable investing. They do not record which criteria.

Prompt: “Please confirm which ESG criteria the client prioritises.”

This keeps the adviser in control and prevents assumptions entering the report.

Why this improves compliance

Clarification prompts:

- surface missing facts before finalising the report

- collect precise wording that reflects the conversation

- link rationale to evidence and source

- reduce back-and-forth with compliance teams

Early adopters report faster completion times and stronger, more defensible reports.

Human-in-the-loop safeguards

Financial advice cannot rely on auto-filled gaps. Aveni flags issues but does not invent content. Advisers verify:

- client circumstances

- advice rationale

- statements tied to meetings and documents

Compliance teams can review AI-assisted drafts before release to ensure firm standards are met.

Stronger audit trails

Every prompt is recorded, including:

- what was flagged

- the adviser’s response

- the time and source

This shows an active process to close gaps. It proves that partial information was not accepted and that client interests were considered before finalising recommendations.

Benefits for compliance teams

The workflow shifts from reactive checking to proactive guidance:

- configurable prompts for known risk areas, such as vulnerability evidence

- consistent outputs across advisers and offices

- fewer resubmissions and less rework

Role-based controls support oversight without creating bottlenecks.

Why multi-source matters

Advice unfolds over many touchpoints. Aveni brings them together. It also spots conflicts or changes over time, such as shifting objectives or risk tolerance, and asks for clarification. For joint cases, it ensures each client’s objectives, preferences and risk are recorded separately.

→ See how patterns repeat in your workflows (and what to do about them)

Implementation made simple

Clarification prompts slot into existing workflows:

- integrates with leading CRMs

- works with your Word templates

- prompts appear during draft review

Firms can pilot with a small group, expand to more scenarios, then standardise. Outputs remain standard Word files.

→ Discover the steps for financial firms should take in order to drive proper adviser AI adoption

The outcome

- Reports are complete the first time

- Documentation meets FCA expectations for evidence, personalisation and traceability

- Advisers spend less time on rework and more time with clients

- Compliance risk falls while quality rises

Ready to close documentation gaps? Book a demo to see how Aveni Assist uses clarification prompts to produce complete, compliant, client-specific suitability reports.

Make every suitability report audit-ready

Discover how Aveni Assist embeds compliance into every document. Book a tailored demo today.

Aveni provides technology solutions to support compliance workflows. Financial services firms retain full responsibility for meeting their regulatory obligations. Implementation and results vary by organisation. (with inner padding)