File checks sit at the heart of compliance in advice networks. They provide the evidence boards and regulators expect, ensuring client files are complete, advice is suitable, and outcomes meet the standards set under Consumer Duty.

But for large advice networks, the volume is overwhelming. Hundreds of firms, thousands of advisers, and tens of thousands of client files quickly build into a backlog. Compliance teams become buried in manual reviews. Advisers wait weeks for feedback. Inconsistencies creep across firms.

The end result are bottlenecks that frustrate advisers, inflated costs, and increased risks of oversight gaps.

→ Related: Six questions every wealth management board should be asking about AI

Why Manual File Checks Hold Networks Back

Traditional file-check processes are slow, resource-heavy, and reactive. For networks, the challenges multiply:

- Scale: Even small inefficiencies compound when applied across hundreds of firms.

- Inconsistent standards: Compliance teams interpret requirements differently, creating uneven oversight.

- Delayed feedback: Advisers may wait weeks for outcomes, which slows service and limits learning.

- Reputational risk: One firm’s oversight failure can damage the standing of the entire network.

Manual file checks are essential, but they cannot keep up with the scale at which networks now operate.

Consumer Duty Oversight Beyond Traditional Reviews

The FCA’s Consumer Duty has raised expectations. Networks must prove that good outcomes are delivered consistently across member firms. Sample-based file checks are no longer enough.

Boards are accountable for evidence, not anecdotes. They need standardised reporting that cuts through volume and shows where risks lie. Compliance teams need tools that go beyond reviewing individual files. They need visibility across the entire network.

How File Check Automation Works in Practice

AI is not about replacing human oversight. It’s about making it scalable, consistent, and less dependent on endless manual effort.

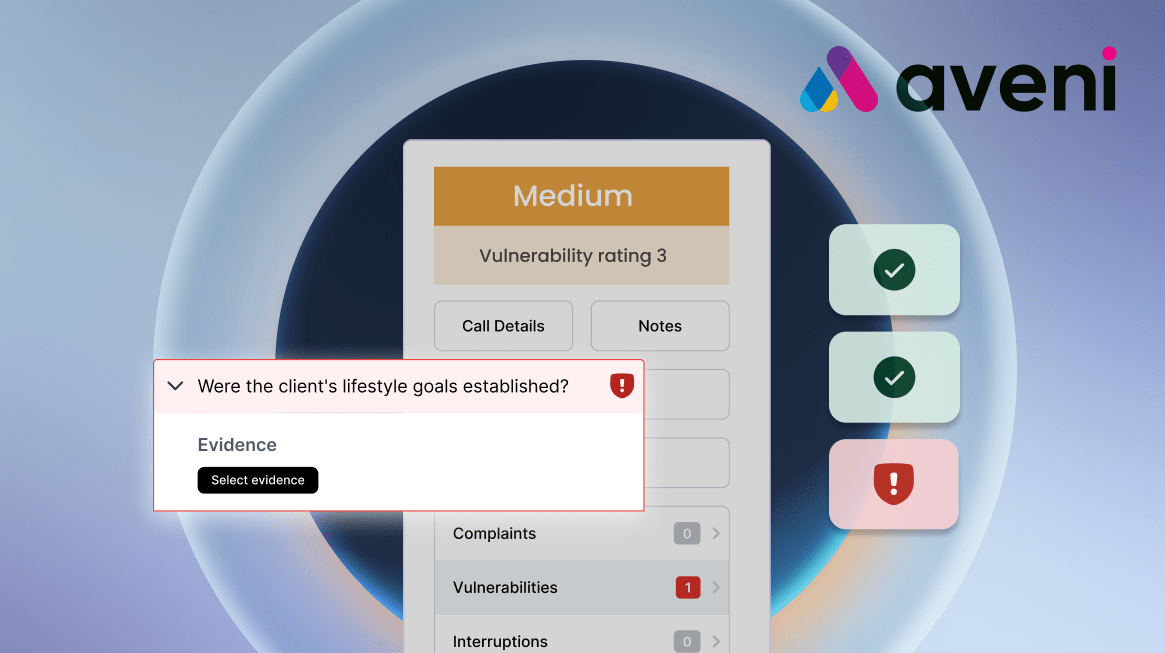

With Aveni Detect, networks can:

- Use pre-built Consumer Duty questions to assess advice against FCA expectations.

- Access dashboards that show patterns in adviser conduct, customer understanding, complaints, and vulnerability.

- Drill down from network-wide performance to individual conversations when issues arise.

- Automate repetitive checks, freeing compliance officers to focus on judgement calls and higher-value investigations.

This approach keeps humans in control, without forcing every review through the same bottleneck.

The Business Impact of AI Compliance in Advice Networks

Networks adopting AI-powered QA gain:

- Efficiency: More advice reviewed with less manual workload.

- Consistency: Advisers assessed against the same benchmarks across all firms.

- Confidence: Clear, regulator-ready reporting for boards and the FCA.

- Scalability: Oversight that grows with the network without adding compliance headcount at the same pace.

This isn’t about cutting corners. It’s about strengthening the quality of oversight while removing the friction that slows firms and advisers.

→ See how private banks are balancing trust and oversight with AI

Moving From Bottleneck to Scalable Oversight

A smarter QA model for advice networks looks like this:

- Pilot AI-supported QA in one part of the network to prove time saved and risks surfaced.

- Roll out dashboards that standardise how Consumer Duty evidence is tracked across firms.

- Shift culture from reactive policing of files to proactive monitoring of outcomes.

For boards, this means visibility across the whole network. For advisers, it means faster, clearer feedback. For compliance teams, it means moving from firefighting to meaningful oversight.

→ Explore Aveni’s framework for scaling enterprise AI implementation

Compliance success with AI-powered QA

File-check bottlenecks no longer need to be the price of compliance. With AI-powered QA, advice networks can reduce manual workload, improve oversight, and protect their reputation.

Smarter QA doesn’t replace human expertise. It gives compliance teams the tools to do their jobs better, faster, and with more confidence.

See how Aveni Detect helps advice networks cut file-check bottlenecks and deliver regulator-ready oversight. Book a demo →

From bottleneck to scalable oversight

Standardise QA across your advice network. Prove Consumer Duty outcomes with complete evidence.