Creating suitability reports is one of the most time-consuming and error-prone parts of the advice process. Advisers and paraplanners spend hours piecing together data from meetings, fact finds, CRMs and product docs. For large networks, this adds up to thousands of hours lost each year and significant compliance risk.

Suitability report automation changes this. With Aveni Assist, firms can generate client-ready reports in minutes, not hours, drawing on multiple data sources and controlled templates. This approach reduces cost, strengthens oversight, and ensures every report is audit-ready.

Why manual report production holds firms back

-

Fragmented data: Key facts sit across CRM systems, meeting notes, illustrations and risk tools.

-

Repetition: Advisers re-enter information and copy text between templates.

-

Inconsistency: Disclaimers, disclosures and vulnerability notes drift from approved language.

-

Slow sign-offs: Compliance approvals via e-mail create delays and versioning issues.

-

Weak auditability: It’s difficult to prove which data sources informed which recommendations.

→ Read our earlier analysis: How to Fix the Suitability Report Bottleneck in Financial Advice

Document generation built for advice workflows

Aveni Assist now automates the production of:

-

Suitability Reports

-

Provider and client letters

-

ISA withdrawal letters

-

Annual review documents

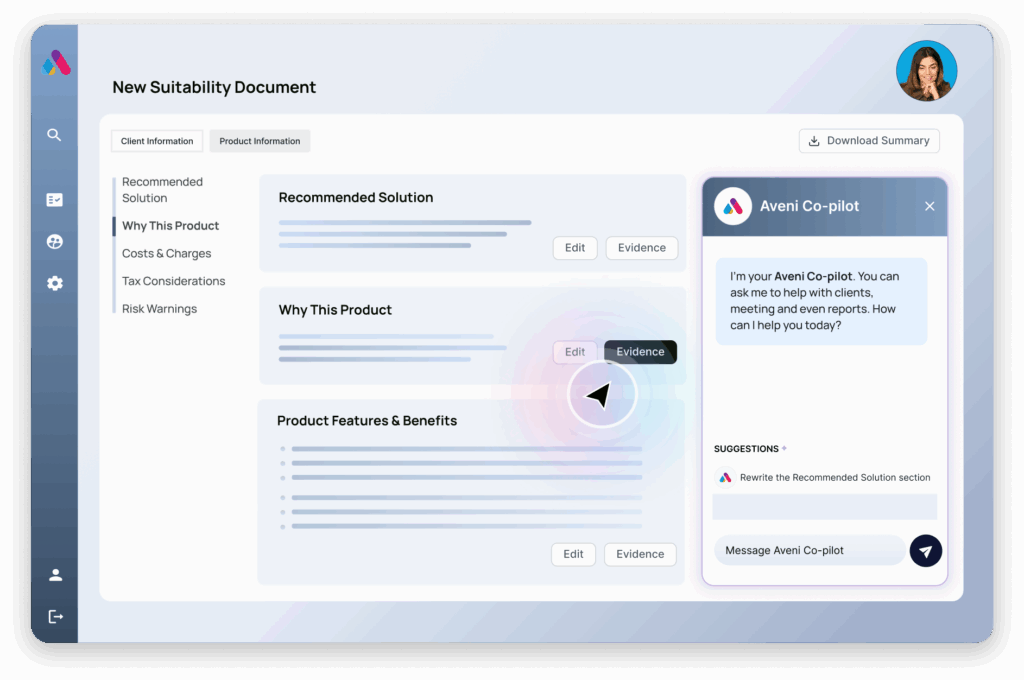

It combines information from meeting summaries, fact finds, CRM data (iO, Xplan, Intelliflo) and uploaded files (Word, Excel, PowerPoint, PDFs) into a single, coherent document.

Unlike templating tools, Assist works with the Word templates you already use. Firms can upload, test and manage their own formats without technical setup or external consultants. This means instant adoption, no hidden costs, and full control of tone, branding and layout.

→ See how it works in practice with Aveni Assist

From multiple meetings to one report

Real-world advice spans multiple conversations and touchpoints. Most AI tools summarise a single meeting. Assist was built for multi-meeting, multi-source advice journeys, capturing everything from initial discovery to final recommendation.

This ensures reports reflect the full context of the client relationship, not just the latest call, and strengthens evidence under the FCA’s Consumer Duty.

→ Read about our Advanta Wealth partnership to see the impact in practice

Controls that make automation safe

Automation only works at scale if compliance teams remain confident in the outputs. Aveni Assist Suitability Reports include:

-

Template control: upload, edit and govern templates internally, with role-based permissions

-

Locked content: mandatory wording for disclaimers, Consumer Duty language and fee disclosures

-

Approval workflows: adviser → paraplanner → compliance with full version history

-

Human-in-the-loop oversight: every draft is reviewable, editable and traceable before client issue

-

Auditability: evidence packs link each paragraph to its data source, reviewer and approval step

→ Learn more about governance and oversight in AI Governance: Building Trust and Compliance in Financial Services

Integration with the tools you use

Aveni Assist integrates seamlessly with:

-

Xplan for data and illustrations

-

Intelliflo Office for fact finds and CRM records

-

Other enterprise systems via API

This means data flows automatically into reports, reducing manual input and minimising errors.

Enterprise-ready for scale

-

Supports multi-adviser networks with role-based access and centralised governance

-

Works for single and joint clients out of the box

-

Handles high-volume use cases like annual reviews or ISA withdrawals

-

Produces client-ready, compliance-checked outputs with no extra rework

For distributed teams, this ensures every adviser works with the same templates, the same disclosures and the same standards.

What firms achieve with suitability report automation

-

Reduce preparation time from around 90 minutes to about 15 minutes per report

-

Save thousands of paraplanner hours each year

-

Improve compliance through locked templates and traceable evidence

-

Increase adviser capacity to spend more time with clients

-

Provide boards and regulators with complete audit trails

Next step

Suitability report automation can transform adviser productivity, compliance oversight and client experience.

Schedule a time to chat with our team to get started with suitability report automation. We will show how Aveni Assist can cut report production time, improve consistency and provide audit-ready evidence across your network.