The future of debt recovery is at a critical point. It’s facing some serious challenges and a lot of scrutiny, especially around how it treats vulnerable consumers. The UK economy isn’t helping matters, with predictions of sustained inflation and interest rates. The housing sector is feeling the pinch too, with companies finding it tough to collect payments and keep the lines of communication open with indebted customers. With these pressures piling up, the future of debt recovery is set to get even harder, particularly when it comes to looking out for those who are most vulnerable.

For Quality Assurance (QA) Assessors , it’s now more important than ever to assess more cases, more efficiently, all whilst digging deeper and more effectively into customer vulnerability trends not just on an individual level, but at a population level too.

Phew!

Sound like a lot?

This is where AI (Artificial Intelligence) powered platforms, such as Aveni Detect, come into play. AI offers new approaches that can reshape debt recovery operations. But how much of a difference can AI tools make?

01. 100% of calls monitored

Having the ability to analyse every single customer interaction is a game-changer for the future of debt recovery. We’re not trying to reinvent the wheel but when you think of current call monitoring processes, there’s a lot of vital information that can slip through the cracks. We know that current sampling covers only a fraction of the calls a business makes or receives, which leaves vulnerable customers and regulatory compliance at risk. Bridging that gap is key to ensuring that firms can see the bigger picture of their customers, from individual needs to societal shifts.

With the economy on shaky ground and a challenging few years on the horizon, developing an understanding of customers that goes beyond the surface level is key. 100% coverage of calls might not always be a regulatory necessity, and may feel like something of a momentous task, but for a business in the financial sector, it can offer unprecedented insight into how things are shaking out.

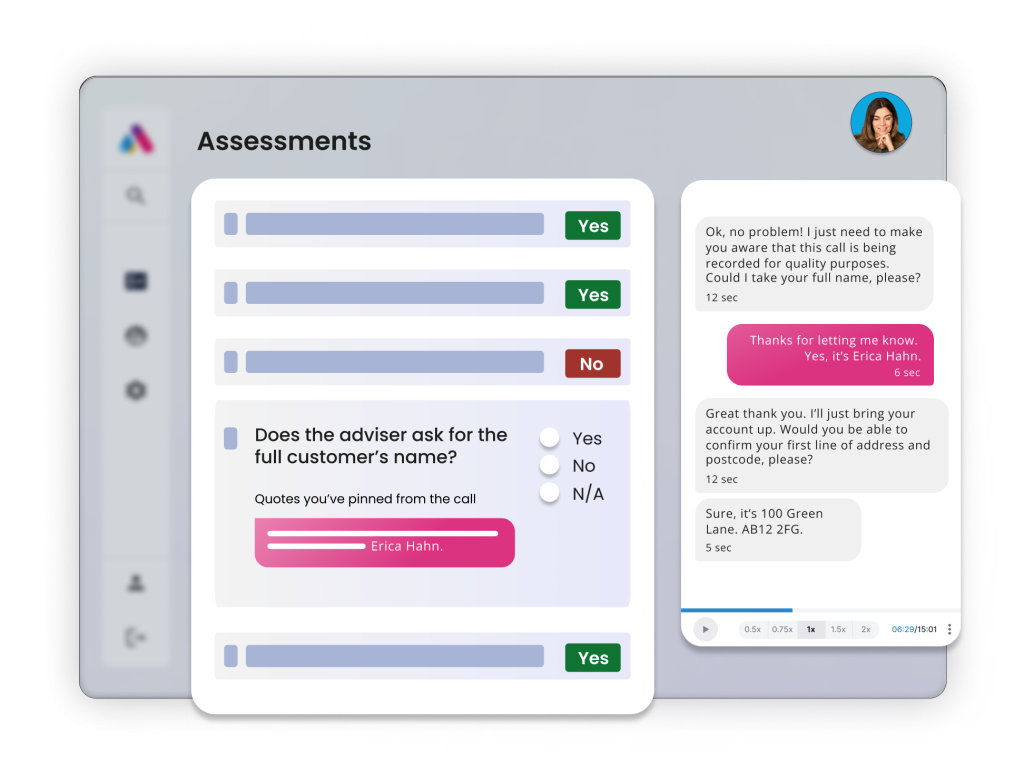

Having a Human-in-the-Loop (HITL) remains essential when we look to ensure that those most vulnerable are treated with dignity and respect. UK regulators are taking a firm stance against aggressive debt collection tactics, warning that ‘robust action’ will be taken against companies using threatening tones or overwhelming vulnerable borrowers with excessive communications about their debts. Finding harmony between comprehensive machine analytics and human understanding of emotional nuance will be the path that will lead to the best outcomes for everyone.

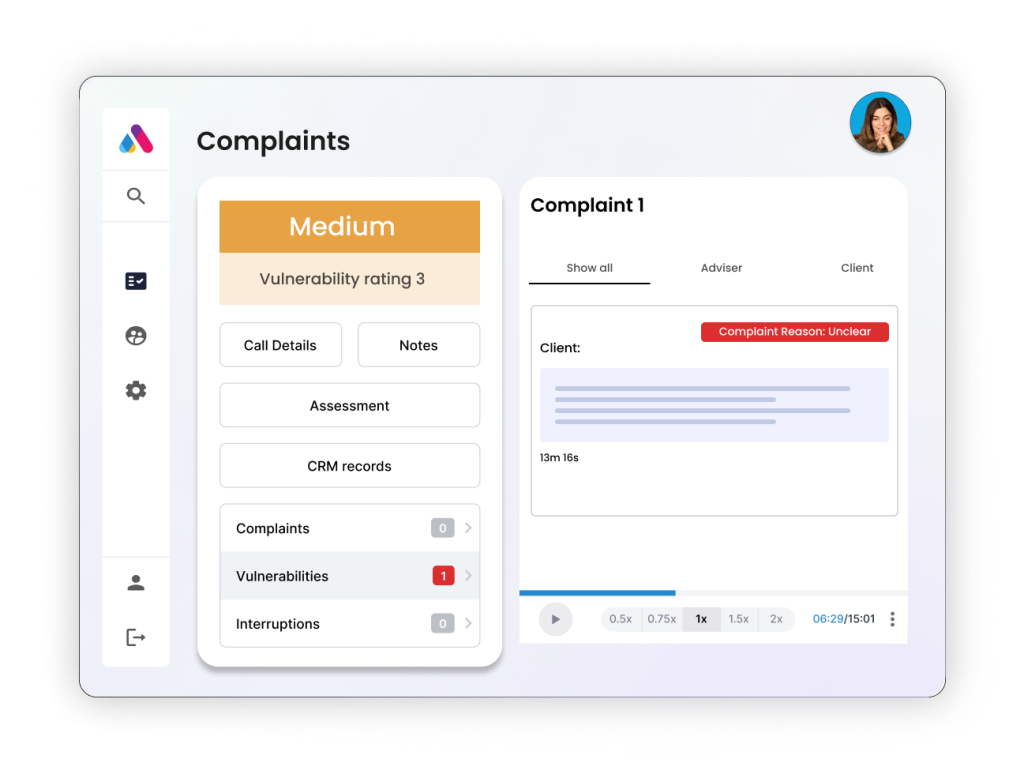

With the ability to monitor customer communications more thoroughly, firms can prioritise the calls of highest risk in real-time for human review, allowing for immediate interventions and improvements in call quality and prevents instances where the debt recovery agent might be potentially intimidating or overwhelming customers.

On top of this, being able to identify a pattern of training needs for your agents means that you can also be proactive about their development, putting strategies in place to build their skills and improve customer interactions as well as regulatory compliance, all of which is crucial for the future of debt recovery.

02. Consumer Duty compliance – putting consumers first

We could backlink a hundred blogs that hammer home the last two years of Consumer Duty regulations. We know that the Financial Conduct Authority (FCA) means business when it comes to the fair treatment of customers. But identifying customer vulnerability is a real challenge. Not only do advisers often struggle to recognise when a customer may need additional support, the customer themselves may not realise that they’re considered vulnerable.

This push for clearer, more effective communications can help customers make informed decisions. Firms need to adapt their communication strategies to meet the needs of all customers, including those with vulnerabilities.

But how?

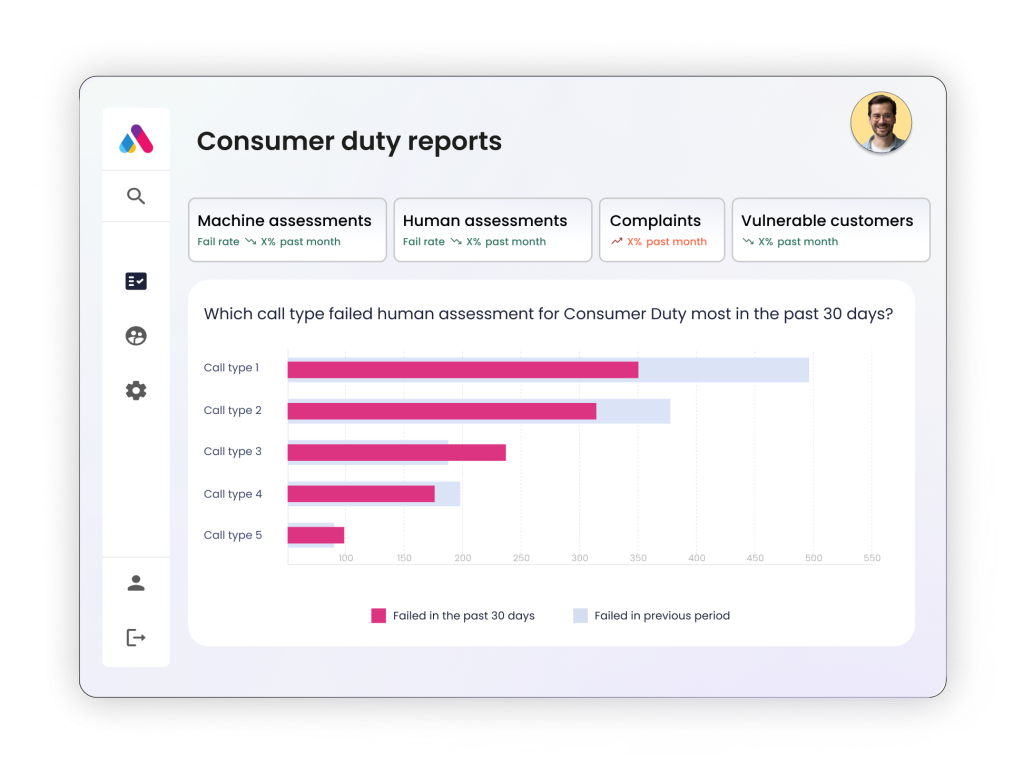

As we’ve mentioned, Consumer Duty requires firms to continually assess the effectiveness of their actions in delivering good customer outcomes. This necessitates robust data collection, analysis, and reporting systems. This is where advanced AI solutions can help firms better recognise, record and respond to vulnerable customers in real-time, as well as gathering insights into the bigger picture.

But the fair treatment of customers is just one of the key pillars when it comes to Consumer Duty. By integrating software that can automate time consuming processes and analyse 100% of customer interactions, means that additional key performance indicators (KPIs) can be assessed at scale, providing insights to compliance trends over time.

As Consumer Duty demands cultural change within debt recovery firms, there comes a need to embed compassion and understanding throughout your organisation. Using an overview of your operations, it becomes easier to train staff at all levels to understand and implement the new standards and get everyone working on the same page.

03. Advisers still need to see the revenue returns

While the customer remains the heart of any business, it’s also important to remember that businesses need to make money. It’s the nature of any industry, not just financial services. So revenue generation should be factored in when considering the future of debt recovery.

For third-party debt collectors, solutions like Aveni Detect can be a real differentiator to set you apart from other businesses. Not only can you give firms that your operations are above board, you have data-backed evidence recorded and analysed to showcase compliance at the highest level.

As a debt collector looking to scale compliance in an affordable way, Aveni Detect can help you do this. With AI support, you can achieve a much higher level of coverage at a fraction of the cost that would be required if you were trying to throw people at the problem to achieve the same coverage.

If you’re now able to monitor 100% of calls, you can provide valuable insights to customer needs and preferences, boosting more personalised and effective debt recovery strategies. This goes beyond simply satisfied customers. This could mean an increased rate of recovery.

You may also find that full coverage of customer interactions shapes the way that you improve your services and products, strengthening your operations and bringing new revenue streams to your business, as well as opening doors to returned customer business and referrals.

Opening the door to AI solutions is key to the future of debt recovery because it shifts the burden of time consuming tasks from QA assessors to an automated system. Taking 90 minute tasks down to less than 15 minutes returns a substantial amount of time from low-value operations that can be fed back into the areas that truly matter.

So what does this mean for the future of debt recovery?

The purpose of AI solutions like Aveni Detect are not to replace the staff you have, rather to enhance the crucial human interactions within your operations. It comes as no surprise that, when we’re talking about our finances, customers don’t want to deal with robots or cold third-parties reading from a script. By utilising a comprehensive solution for modernising your debt recovery process, enhanced AI-powered platforms are transforming the way firms are approaching the future of debt recovery.

As the industry continues to face increasing regulatory pressure and compliance expectations, as well as customer expectations, tools like Aveni Detect will be crucial in maintaining compliance whilst demonstrably improving operational efficiency and customer outcomes.